about it, people really feel like they

can get the best deal if they get a fore-closure

or a short sale, and in a lot of

cases you can, but not all the time,”

Michelle Clark says. “But some people

are only going after foreclosures and

short sales because they want to get

such a great deal, and they’re getting

them. There are tremendous opportu-nities,

and most of them are short sale

and foreclosure. Investors are buying,

trying to get the best deal and it’s also

people that will be using it but, they

still want to get the best deal for that

price, that’s all people care about right

now ... value, value, value, deal, deal,

deal, cheap, cheap, cheap.”

Randy Williams comments, “Many

of the issues with troubled properties

have been resolved, either through

bankruptcy, foreclosure or the short

sale process. Wrightsville Beach was

not immune from those calamities,

but it was not of epidemic propor-tion

like it was in so many other

communities.”

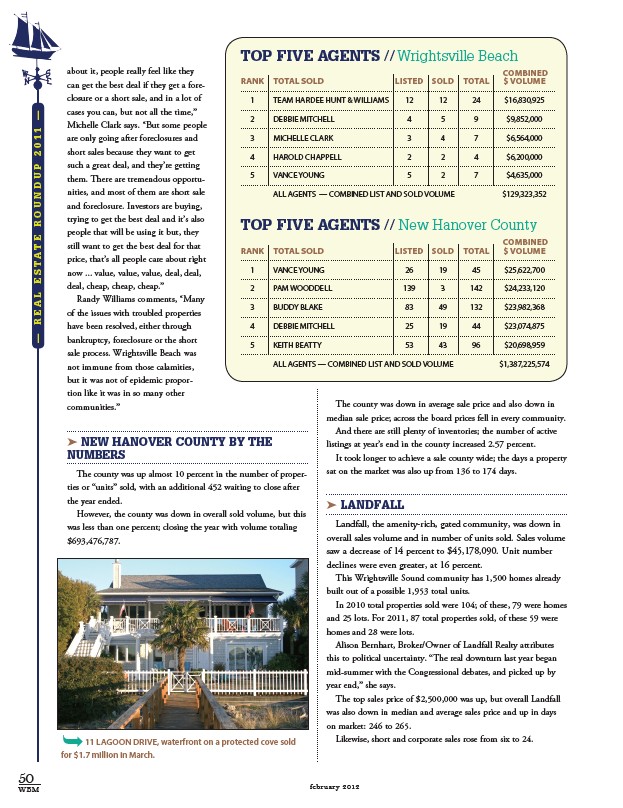

Top Five Agents // Wrightsville Beach

combined

Rank Total Sold Listed Sold total $ volume

1 Team Hardee Hunt & Williams 12 12 24 $16,830,925

2 Debbie Mitchell 4 5 9 $9,852,000

3 Michelle Clark 3 4 7 $6,564,000

4 Harold Chappell 2 2 4 $6,200,000

5 Vance Young 5 2 7 $4,635,000

All Agents — Combined List and Sold volume $129,323,352

Top Five Agents // New Hanover County

Rank Total Sold Listed Sold total $ volume

1 Vance Young 26 19 45 $25,622,700

2 Pam Wooddell 139 3 142 $24,233,120

3 Buddy Blake 83 49 132 $23,982,368

4 Debbie Mitchell 25 19 44 $23,074,875

5 Keith Beatty 53 43 96 $20,698,959

All Agents — Combined List and Sold volume $1,387,225,574

New Hanover County by the

numbers

The county was up almost 10 percent in the number of proper-ties

or “units” sold, with an additional 452 waiting to close after

the year ended.

However, the county was down in overall sold volume, but this

was less than one percent; closing the year with volume totaling

$693,476,787.

The county was down in average sale price and also down in

median sale price; across the board prices fell in every community.

And there are still plenty of inventories; the number of active

listings at year’s end in the county increased 2.57 percent.

It took longer to achieve a sale county wide; the days a property

sat on the market was also up from 136 to 174 days.

Landfall

Landfall, the amenity-rich, gated community, was down in

overall sales volume and in number of units sold. Sales volume

saw a decrease of 14 percent to $45,178,090. Unit number

declines were even greater, at 16 percent.

This Wrightsville Sound community has 1,500 homes already

built out of a possible 1,953 total units.

In 2010 total properties sold were 104; of these, 79 were homes

and 25 lots. For 2011, 87 total properties sold, of these 59 were

homes and 28 were lots.

Alison Bernhart, Broker/Owner of Landfall Realty attributes

this to political uncertainty. “The real downturn last year began

mid-summer with the Congressional debates, and picked up by

year end,” she says.

The top sales price of $2,500,000 was up, but overall Landfall

was also down in median and average sales price and up in days

on market: 246 to 265.

Likewise, short and corporate sales rose from six to 24.

— R e a l e st a t e R o u n d u p 2 0 1 1 —

11 Lagoon Drive, waterfront on a protected cove sold

for $1.7 million in March.

50

WBM february 2012

combined