SHORTS

RISK RATING 2.0

Introducing the new national flood insurance program

TBY LISA A . SHARRARD | PHOTO BY ALLISON POTTER HE National Flood Insurance Program (NFIP) underwent

a major overhaul, effecting new commercial and residential

policies beginning Oct. 1, 2021, and policy renewals begin-ning

April 1, 2022.

The legacy rating system was primarily based on the lowest floor of the

structure in relation to the base flood elevation and corresponding flood

zone. Under the new system, Risk Rating 2.0, the replacement cost value,

square footage of the subject property, distance to water, and foundation

types will be considered when determining flood premiums.

Existing policy holders need not fear huge rate increases, as most

premiums are capped at a 15-18 percent increase per year. According to the

Federal Emergency Management Association (FEMA), 26 percent of policy-holders

in North Carolina can expect to see a reduction in their premiums,

including severe repetitive loss properties. Alternatively, 65 percent may see

an increase of less than $10 per month, with 9 percent seeing an increase of

more than $10 per month.

Unlike prior program changes, this one includes positive benefits to some

policy holders, the first being that elevation certificates are now optional.

However, it is important to note that we are seeing some reductions in premi-ums

when elevation certificates are submitted for underwriting consideration.

Since the NFIP will no longer be strictly using flood zones to determine

premium rates, this also removes the need for property owners to obtain map

amendments for more favorable ratings. Grandfathering based on flood zones

or base flood elevations will be phased out over time. For real estate trans-actions,

assigning the flood policy from the seller to the buyer is no longer

necessary. Every buyer should, however, obtain a copy of the seller’s flood

insurance policy.

If you are considering making changes to your home or other property,

elevating the mechanical equipment above the first living floor or adding

approved/certified flood vents to your foundation may assist in lowering

your rating. We highly recommend contacting your flood insurance agent to

confirm how your policy may be affected before making any modifications to

your property unless those changes are for the express purpose of complying

with local flood mitigation or local floodplain management ordinances.

For more information about changes to the NFIP, please contact your

trusted flood insurance agent.

Lisa A. Sharrard, CFM, CPM, ANFI, is owner of Choice Flood Insurance.

Before entering the private sector in 2010, she served as the NFIP Coordinator

for the South Carolina Department of Natural Resources. At FEMA’s invita-tion

she had input into Risk Rating 2.0.

20 february 2022

WBM

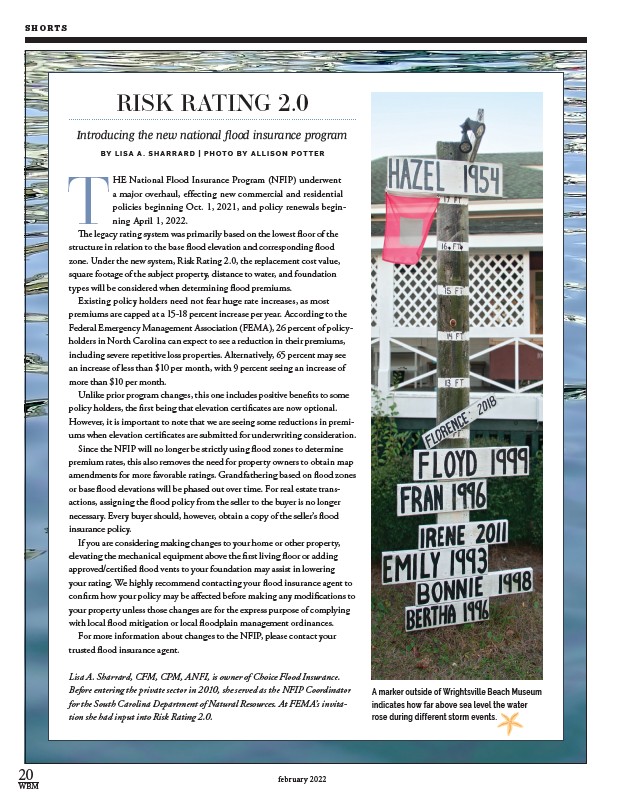

A marker outside of Wrightsville Beach Museum

indicates how far above sea level the water

rose during different storm events.