Real Estate Roundup: A Tale of Two Halves

Finding our normal

BY Pat Bradford, Christine R. Gonzalez, Amanda Lisk, Fritts Causby and Taylor Hammeke

Coming off 2021, the most remarkable year in history of the real estate business locally, no one knew what to expect for 2022.

“Transition,” Carla Lewis, of Intracoastal Realty, says.

Normalized has been a frequent description of what happened. Slowed and flattening are others. Correcting even.

At the beginning of the year, inventory was critically low and arguably never lower than it’s been nationwide.

“The biggest thing driving prices and the market is inventory. This started before Covid. The biggest reason for the nationwide shortage is we have been underbuilding for the last 15 years. The supply of land and houses cannot keep up with the demand,” says Jessica Edwards, Coldwell Banker Sea Coast Realty. “At the end of 2019, in New Hanover County in December there were 1,326 active residential listings. Two years later in December 2021 there were only 479 active homes for sale that month.”

At the end of 2022 there were 709 active listings.

“When you look at 2022, you have to take into consideration the historic jump in housing prices that happened after February 2020,” says Edwards.

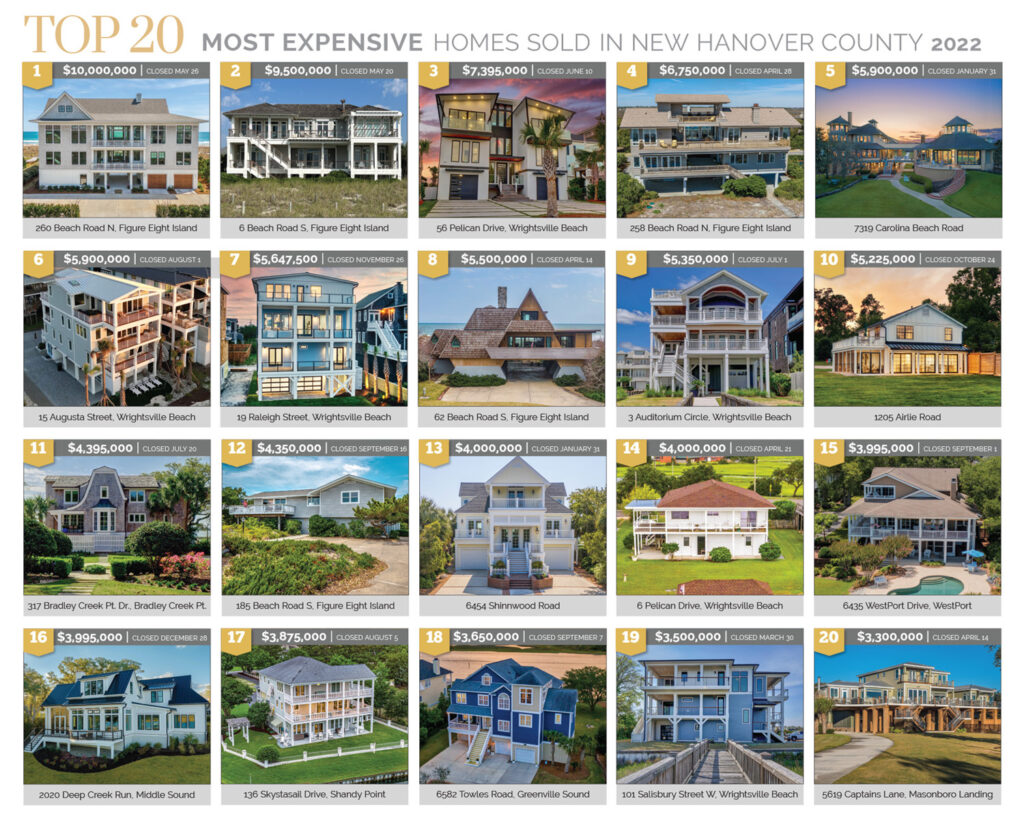

There were 23 single-family residential sales in 2022 that closed between $3 million and a headliner $10 million sale.

“It’s a tale of two halves,” says Vance Young, a broker with Intracoastal Realty who has logged 35 years working this market. “The first half was a continuation of the Covid bump, buyers discovering the area. That’s going to be the positive legacy of Covid, people moving out of the cities, working from home, a tighter family unit as a result. Quality of life became more important than ever. That’s driving relocation to all of southeastern N.C.”

Everyone knew the dramatic upturn in the market would slow at some point and mid-year it did.

“The other half — things slowed dramatically mid-year,” Young says. “The appreciation phase is over, for now, but I think it’s going to be a very limited downside. I don’t think it’s going to be like 2008. I think the lack of inventory is going to steady the market.”

It was a remarkable year. The top residential sale was 260 Beach Road North, Figure Eight Island, which caused quite a stir in May when it closed at $10 million. This set a record for luxury properties, and was the first double digit million-dollar sale in the tri-county area. A second top sale of 6 Beach Road South a few days prior at $9.5 million had already set tongues wagging.

The sales were connected.

“The buyer for 6 Beach Road South actually called me and said, ‘Hey, I really like this house, will you call them and see if they will sell it to us?’” says Nick Phillips. “Fortunately, Sam Crittenden [Landmark Sotheby’s] had the relationship with the [Mack] Brown family.”

At the same time, 260 Beach Road North had just come on the market listed with Jo El Skipper, broker with Figure Eight Island Realty.

“The Browns were willing and ready to sell 6 Beach Road South to my clients,” Phillips says. “My clients had recently sold a company in New York City and they discovered Figure Eight Island during Covid, and had fallen in love with it.”

Figure Eight Island is a private 5-mile, 1,300-acre barrier island with approximately 475 privately owned, single-family homes. The previous high sale of the year there was $6.75 million at 258 Beach Road North, selling in April.

“Folks there have not been willing to let go of their property. In 2020 there were 32 sales on the island. In 2021 there were 20 and then in 2022 there were seven. Of those seven, five sold over the $5 million mark. The lack of inventory is driving prices higher,” says Phillips.

Figure Eight Island also saw a substantial and rare lot sale, No.12 Beach Road South, which offered 100 feet of oceanfront. It listed at $3.9 million and sold for $5.133 million.

“It was a very nice lot, with a good-sized building footprint [25,265 sf]. There were no other oceanfront lots available, and nothing had been on the market for quite a while,” Phillips says.

The $5.133 million lot sale predicated the record-breaking home sales.

“The lot that started it all,” Jo El Skipper says as she laughs.

Skipper was worried they had priced the lot too high at $3.9 million.

“We had depleted all the inventory. People were clamoring for oceanfront,” says Skipper.

She found herself in the middle of a domino run of a trio of record-breaking sales.

There were people who had been actively waiting for a lot to come on the market, “… looking and pondering what were they really willing to pay to get what they wanted. It was driven by the lack of inventory,” Skipper says.

Thirteen other residential lots sold in New Hanover County between $1 million and $4 million.

“Waterfront lots in particular sold at a premium, given the diminishing number of unimproved waterfront properties remaining in New Hanover County. The first half of 2022 saw high demand for properties and multiple/competing offers, which led to buyers paying at or above list price in many cases, Intracoastal Realty broker Michelle Clark-Bradley says. “The phrase ‘Location. Location. Location’ is a lasting one. Waking up to a gorgeous water view never gets old, or goes out of style.”

Record-Breaking Sales at Figure Eight

By Amanda Lisk

Figure Eight Island saw a new benchmark sale of $9.5 million on May 20, 2022, a record until it was upstaged six days later by a $10 million sale — the highest single family residential sale ever for the tri-county region, and the first to hit eight figures.

“I think it forever changed Figure Eight Island and our luxury waterfront market in southeastern North Carolina,” says Sam Crittenden of Landmark Sotheby’s International Realty, who represented a seller and a buyer in the two transactions.

The buyer of the $10 million property was the seller of the $9.5 million property, a story of impeccable timing.

Nick Phillips, founding broker of Landmark Sotheby’s, was approached by a buyer to request he assist them in acquiring UNC head football coach Mack Brown’s home at 6 Beach Road South.

Phillips says Crittenden, who had a relationship with Brown and his wife, Sally, approached them, got their agreement, and represented them in the sale to Phillips’ client. Crittenden also assisted the Browns in an almost simultaneous purchase of 260 Beach Road North. Built by Kingpost Construction in 2019, the 5,600 sf oceanfront home had just been listed by Jo El Skipper of Figure Eight Island Realty.

“It was an unbelievable home on a half-acre oceanfront lot in a highly sought-after area of the island and an absolutely incredible build perfectly executed by Kingpost Builders,” says Crittenden.

Setting a benchmark both transactions were preceded by another record-breaking sale of a Figure Eight oceanfront undeveloped lot, which sold in a bidding war at $5.133 million.

“That was the all-time highest single-family lot sale to my knowledge in New Hanover County,” says Phillips, who represented the winning bidder. “For buyers who wanted to build a custom home, this was the one shot they had in 2022. There were five buyers competing for that one parcel. There were buyers who stormed that property immediately when it came on the market.”

Additional top residential home sales in Brunswick, New Hanover and Pender counties were also impressive. Wrightsville Beach held the top two spots on the leaderboard the previous year, but the Figure Eight sales flipped the top two slots back for 2022. Wrightsville came in number three with the beach town’s sale of 53 Pelican Dr. on Harbor Island at $7,395,000. Another record-breaker.

“There’s no other place on the East Coast that’s quite like it. I don’t think Figure Eight and Wrightsville Beach should trade at a discount to anywhere on the East Coast,” says Sam Crittenden.

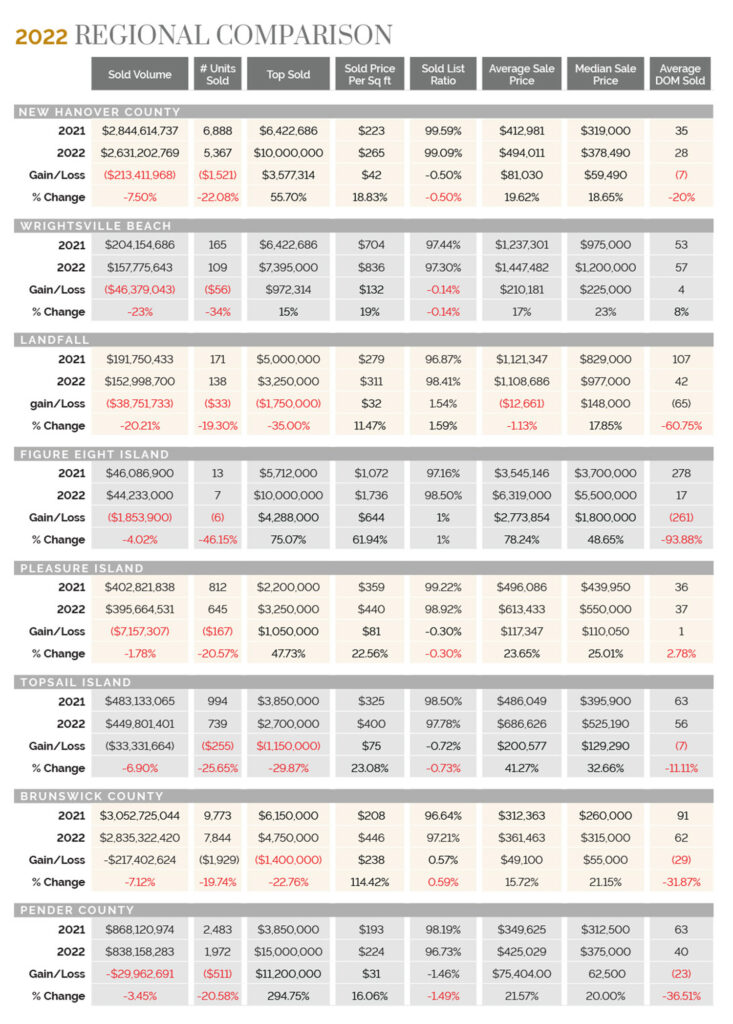

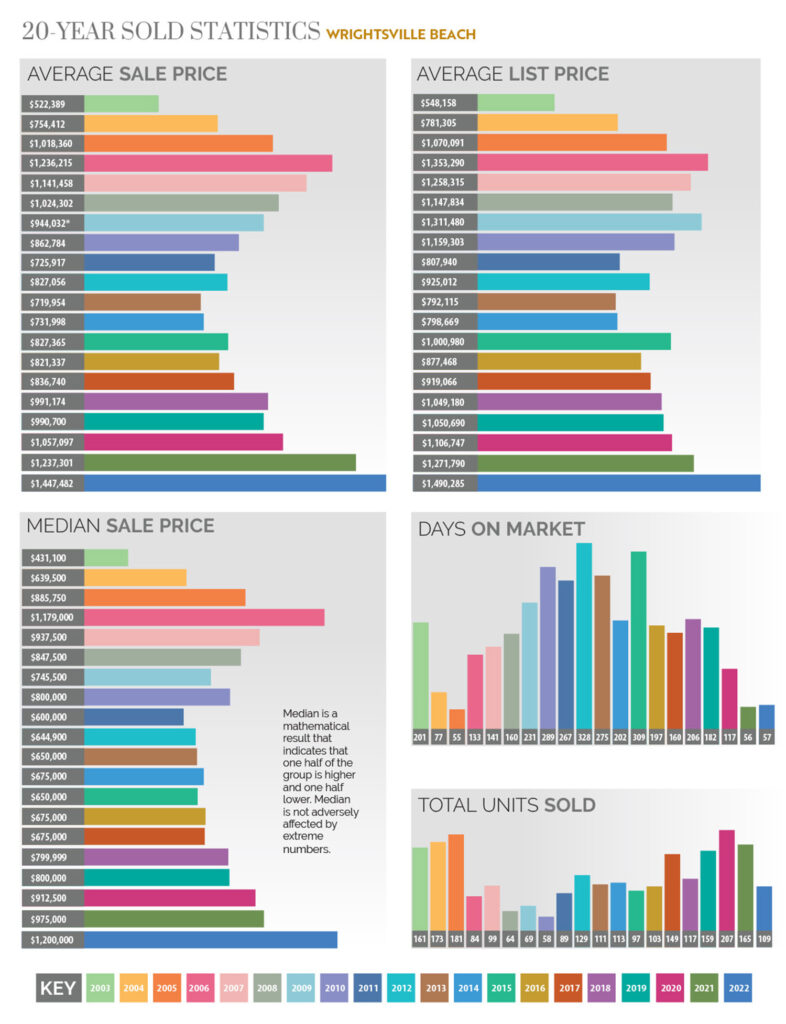

Despite the big-ticket sales, the tri-county area, including the beach towns, all saw a decline in overall sales volume, as well as a decrease in the number of properties sold. Due to the dearth of inventory, Figure Eight Island saw a 46% decline in units sold. Wrightsville had a 34% decline. The inventory at any given time was hovering around a few dozen properties.

“That’s a tight market,” says Randy Williams, broker at Hardee Hunt and Williams.

The largest decline in sold volume occurred at Wrightsville Beach with a decrease of more than $46 million in sold properties.

“There were 58 [residential] properties that went under contract, not counting lot sales, in the first two quarters of 2022,” says Williams. “That number fell to 38 for the last two quarters.”

Taking Figure Eight and Wrightsville out of the comparison, the other localities saw roughly a 20 percent decline in properties sold.

Realtors attributed the decline to one of two factors: the lack of inventory and a rapid increase in interest rates.

“The first two quarters of the year, every market seemed to be off to the races again, with double-digit appreciation. It was probably around June when things started to smell a little. The wet blanket was really starting to cover up some of the transactions. At the least, the exuberance had left the building,” says Ace Cofer, Hardee Hunt and Williams.

The rise in interest rates began as baby steps but then went up in rapid succession.

“The first big rate hike by the Federal Reserve occurred on June 16 when it went up ¾ of a point. This occurred after a May rate increase of a half a point, and a March rate increase of a quarter point. June’s big hike was followed by three more ¾-point increases in July, September, and November. Essentially, rates increased 3.75% from July 16 through the end of 2022,” Randy Williams says.

The good news locally was an increase in the sold price per square foot, average sales price and median price. With two notably higher jumps, sold price per square foot increased everywhere; at Wrightsville they were up 19%, 17% and 23% respectively.

The two extraordinary sales of the seven total sales at Figure Eight rocketed the island community’s averages off the chart. Similarly, an increase of 62% raised the average price per square foot to $1,736. Average days on market was zero. Available listings at year end: one.

While dipping 7.5%, New Hanover County still saw a healthy $2.6 billion in sold volume with 5,367 units sold. When the year ended, there were still 456 properties waiting to close. The average and median sales prices increased 18% and 20% respectively. Days on market decreased 20%.

“When you have a buyer ready to go, and the right property is right there in front of them, they’re going to jump at it,” says Treasure Island broker Kelly U. Parkhurst.

A phenomenon in at least two counties was a shift in location for several of the bigger sales. The No.s 5, 10, 14 and 16 sales were spread across New Hanover County and Wilmington. Water was a factor in all, including the No. 10 sale, 1205 Airlie Road, which sold for $5.225 million to a local buyer. It had been the guest house of a larger home on the property that was damaged by a hurricane and subsequently torn down.

“This property was unique because it was one of the only two that have private piers on Airlie Road. The rest are neighborhood community shared piers,” listing broker Vance Young says.

The No. 5 sale was also located in New Hanover County at 7319 Carolina Beach Road. Built by Fred Murray, the 10,690 sf, four-story residence with separate guest house, pool house, dock and pier sold for $5.9 million in January.

“It was a very rare property, being 10 acres on the waterway in New Hanover County. We have very few parcels like that. The seller had custom built the home as a primary residence and spared no expense. It was a perfect fit for the buyer who also happens to be a local,” Nick Phillips says.

Gated Landfall Country Club saw a 20% drop in sales volume and a corresponding 20 percent drop in number of units sold. Average days on market was 42, a slashing of close to 61%.

“Everything sold in Landfall, the supply and demand still stayed strong, although some prices adjusted mid-year May, June, July and that kept going on through the rest of the year. We’d put something on the market and the showings were strong. For the golfing community, Landfall has been a top destination. People like that it is a gated community, it is still a hot, hot market,” says Carla Lewis of Intracoastal Realty.

Selling at $3.25 million, 1035 Ocean Ridge Lane was the golf community’s top sale. The 6,569 sf property was built in 1995. “Three Bridges,” Landfall’s most iconic home from the waterway, is 2.5 lots, with a 5,000 sf main house, and a 1,549 sf, Nantucket-inspired lighthouse 3 bedroom, 4 bath guest house.

Just over the Intracoastal Waterway via the drawbridge, the top sale at Wrightsville Beach was a 4,989 sf California contemporary home on Harbor Island’s Pelican Drive overlooking Lees Cut. It had all the amenities — a fabulous kitchen, baths, including a spa bath, and huge walk-in shower. This 5 bedroom, 5.5 bath marvel sold for $7.395 million, besting the three-county high sale from the previous year. The seller was a local. The buyer was from the Triangle area.

“Pelican Drive is by far the most sought-after address,” says listing agent Vance Young.

Young notes that Pelican Drive’s deep water is appealing to more and more people. Another allure of Pelican Drive is being off the traffic of the Salisbury St. thoroughfare.

Preconstruction Wrightsville sales have been rare for many years. Two of the Wrightsville top sales were not-yet-built new construction, including 15 Augusta St., which sold in August for $5.9 million. The house features three stories above the garage level, 3,942 sf and a three-car garage. The sold price per square foot was $1,496. The out-of-state buyer has it on a vacation rental program.

“The buyers wanted a new, large home with beautiful views. The design was well thought out, with less, but larger bedrooms. The master bedroom basically encompassed the whole second floor,” says Evan Barton, Cadence Realty.

On Harbor Island, 101 Salisbury St. W. sold preconstruction for $3.5 million with a sold price per square foot of $1,083.26.

Right: Beside the northern bridge (built 1958), east-facing 101 Salisbury St. was sold as pre-construction in March for $3.5 million, 100% of list price. It is one of three new single-family homes on the former location of “The Hut,” Wrightsville Beach’s beloved Pizza Hut torn down July 22, 2004. The land divided into three lots was improved by Kenan Enterprises with a dock and 8 boat slips, but still sat vacant for more than decade. Hardee Hunt and Williams

Oceanfront 19 Raleigh St. was completed new construction, one of the first on the market in many years, and offered 6 bedrooms, 6.5 baths. Its sold price per square foot was $1,497.

The once plentiful, older beach cottages are in serious danger of extinction. No. 9 E. Atlanta, built in 1936 and occupying a highly desirable 50’ x100’ lot, sold for $1.6 million in March. Built in 1937 and located on a 75’ x 80’ near ocean lot, Number 3 East Oxford St. sold for $1.85 million in May.

Also notable was 3 Auditorium Circle on Banks Channel, built in 2014 before the large modern home to its north, which sold for $5.35 million on July 1. The sold price per square foot was $1,232.72.

The 1,920 sf home of former Wrightsville Mayor Fran Russ (1985) at No. 6 Pelican Drive, built in 1996, sold for $4 million. It was sold as a teardown to neighbors who live on the street.

“It was in the heat of things. I had my first offer within 30 minutes of putting the sign in the ground,” Living Seaside broker Caroline Dugas says.

The sold price per square foot came in at $2,083.33. The Lees Cut 58’x134’x62’x143’ lot was a huge draw for future investment. The buyer decided to rent it on Airbnb, then relisted it for sale at $4.4 million.

Wrightsville Micro Markets

“We study tax values often as a line in the sand: date stamped valuation. The intriguing part of the most recent county re-evaluation is that they only used 2020 Covid sales. When you use that line in the sand as sort of a benchmark, and you look to where we are right now, we just wrapped up 2022, so from those sales you’ve got a 24-month cycle. Most micro-markets on Wrightsville Beach are 50 percent above their tax values. So that’s arguably 2% appreciation per month for 24 months. I think everyone would agree that if your property appreciates 2% per month, it’s not sustainable. The sort of double-digit escalated appreciation scale, in some ways, has normalized or flattened,” says Ace Cofer, Hardee Hunt and Williams.

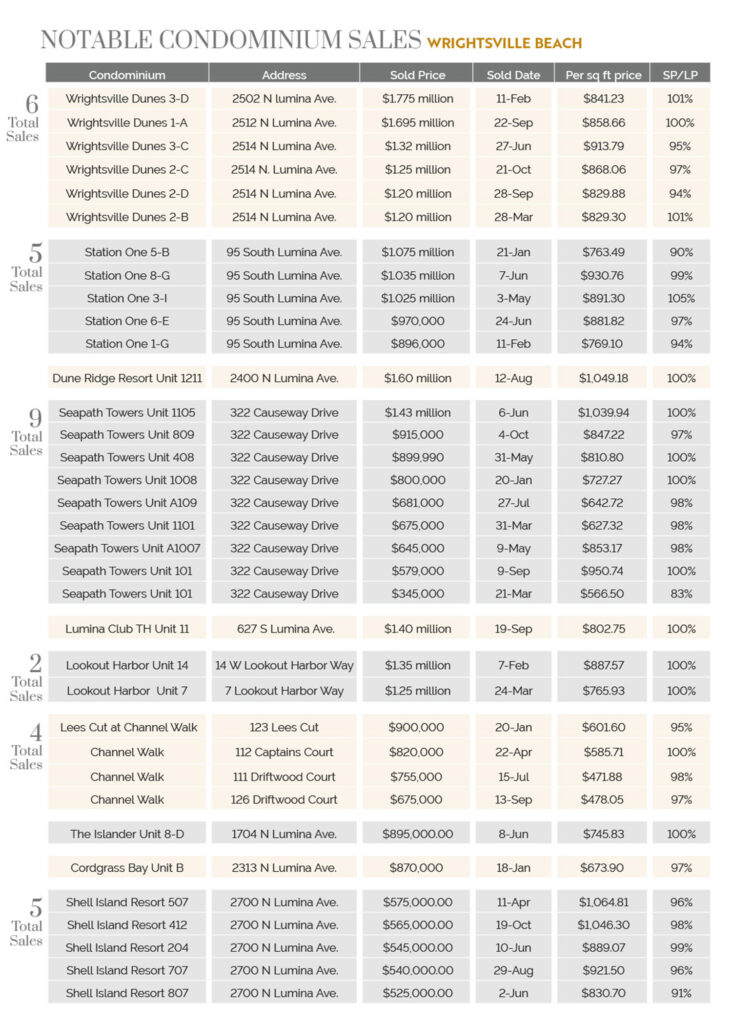

Wrightsville Condos

New to the condominium landscape at Wrightsville Beach were four brand new Intracoastal Waterway-

front units adjacent to the drawbridge area at Wrightsville Yacht Club, 2 Marina St.

All 1,600-1,700 sf units were presold as soon as pilings were in the ground, and each owner bought a 40 foot boat dock. Completed in 2022, the construction took approximately 14 to 16 months.

The B unit was resold in October 2022 for $2.25 million. Fully furnished, it rented for $7,500 per week, and the boat slip required an additional $1,500 per month.

The C unit sold March 11 for $2 million, $1,164.11 per square foot. March saw multiple sales at increasing prices. The A unit sold in March 28 for $2.05 million, and the D Unit sold for $2.095 million on March 30 with the boat slip included.

“Most of these were second-home buyers from Cary, Raleigh, the Triangle area,” Evan Barton of Cadence Realty says. “They wanted convenience and low maintenance. To walk over the bridge to Airlie Road, coffee at Drift, shopping at Redix, the restaurants, a one-stop community. When you come in with a brand-new product, everything is modern — newer floor plans, more entertainment space to entertain family and friends on the weekends. New construction creates a more low maintenance ownership.”

The top duplex/condo sale was 123 & 125 S. Lumina Ave., two structures with two units each in twin buildings. Custom built in 2020 by PBC Design+Build, each unit featured 6 bedrooms, 6 baths, and 3,856 sf in three stories with elevators.

“They are very long, with a lot of depth, kind of shaped like a ship, very cool designs, and a ton of square footage,” Barton says.

The units sold from $2.550 million to $2.895 million, a sold price per square foot of $750.78.

Wrightsville Dunes, on Wrightsville’s oceanfront north end, saw six sales ranging from $1.775 million to more than one at $1.2 million.

Seapath Towers on Causeway Drive experienced the most turnover, with nine units selling between $1.43 million and $345,000 for a first-floor unit, which sold a second time approximately six months later in September for $579,000.

At the extreme north end, with unparalleled views, Shell Island Resort had five sales spread between the spring and fall at a high of $575,000 to $525,000.

Notable in condominium sales, many other units including those in well-established planned unit developments sold for 100% of list price, with a few going over asking price.

Historic Sales for Historic Downtown

Out-of-town buyers drove prices up in downtown Wilmington in 2022, producing a record number of million-dollar transactions. Eleven properties located in the historic district or River Place at 240 N. Water St. sold for $1 million and above, the most properties to ever close at that price point in the downtown area.

“I honestly think Wilmington, our historic district specifically, has been grossly undervalued over the years compared to other cities,” says Lois Potratz formerly of Keller Williams Realty and now with Ivester Jackson Coastal/Christie’s International Real Estate. “Given the development in downtown — the businesses, the entertainment, everything that’s coming and growing — we’ve seen an increased interest and the prices have adjusted accordingly and honestly, they really should have been there all along.”

Vance Young of Intracoastal Realty says this, “For years it would have never been on my radar. Now I could live down there. It’s vibrant, it’s intriguing. I think we’re where Asheville was 10 years ago.”

Potratz’s $1.8 million sale of the Verandas Bed and Breakfast Inn at 202 Nun St. on May 11 tied for the highest in downtown Wilmington with a penthouse that sold Jan. 5 and became the highest ever at River Place.

Stephanie Heller of Intracoastal Realty also sold a second property, Unit 1154 at River Place, a two-bedroom condo that made the top 25, closing at $785,000 in October.

Heller says there’s an increase in younger buyers to the downtown area. Common Desk, a three-story co-working office space in the Gaylord Building on Front St., is a draw for the young professional.

“For the younger generations, it used to be hard to get jobs here, but that has changed,” she says. “It’s just a great vibe. Wilmington has become very youthful. There’s a lot of revitalization going on that’s really brought people downtown.”

Another bed and breakfast, the C.W. Worth House at 412 S. Third St., was sold by Potratz in February for $1.04 million to a young couple from Raleigh.

One of Wilmington’s most iconic historic mansions, the 140-year-old Honnet House at 322 S. Front St., sold for $1.1 million to buyers from the Washington, D.C., area.

“A job brought them here. They are going to renovate it and live in the house,” says Lynne Boney of Intracoastal Realty. “Historic homes are larger and grander in proportion. And, if you think about the lifestyle of downtown, you can walk to just about anything.”

In November, Jan Brewington of Dram Tree Realty sold the Fennel-Croom House at 610 Dock St. for $1.3 million, $100,000 above list price.

“The buyers are from Charlotte, their dream was to retire in downtown Wilmington,” says Brewington.

Potratz says 75% of her sales were cash transactions and buyers are coming from new areas.

“I had people moving here from places I’ve never had before, three from Kansas, four from Colorado,” she says.

What’s being called the gentrification of the Wilmington downtown is a sharp uptick in rejuvenation causing great angst for those with deep roots in the community, some going back to pre- and post-Civil War days. Generationally owned properties, now owned by multiple extended family members, are increasingly being sold and redeveloped, unnerving some residents of historically black communities.

Jeff Hovis is a commercial and residential broker with Intracoastal Realty.

“I handle quite a few rental-residential portfolio sales,” he says.

Hovis closed last year on one with 96 units that were individual single-family rental properties held by one landowner in neighborhoods impacted by some of these transitions.

“Everything was west of Eighth St. in the downtown area. Those rentals are generally in neighborhoods that have impacted a number of homeowners in a positive way. It has increased their property values, enabling them the opportunity to improve their property, or to get the best price out of a property. A lot of these houses were sitting vacant, in a state of disrepair in the downtown neighborhoods,” Hovis says.

On the north side, modest homes that once sold for under $100,000 have been improved and are being snapped up at $200,000-$350,000, a sought-after price point in all of Wilmington and New Hanover County.

“I have always viewed gentrification as part of the economic process. Growth and development. Developers are buying properties that are distressed,” says John Hinnant, vice president of Eastern Carolinas Commercial Real Estate and formerly president and CEO of Wilmington Downtown Inc., the city and county’s economic partner. “It’s not just developers, it’s also upwardly mobile young professionals who want to be downtown as a part of a revitalization. It’s like social investment.”

The lack of inventory coupled with a steady influx of new residents has made Wilmington’s north side a hot market.

“Downtown is also the largest inventory of affordable housing stock,” Hinnant says. “It’s natural for a first-time home buyer to be drawn to an area of affordable homes. They make improvements and they put sweat equity into these houses, and then a life event happens; they have children, or they are ready to downsize.”

There seems to be no end in sight to the turnover, which is driving up prices.

“The south side is really starting to pick up. I love to see revitalization of neighborhoods. That’s good for everybody,” says Deb Hayes, New Hanover County commissioner and broker at Intracoastal Realty.

Brunswick County

By Christine R. Gonzalez

Brunswick County saw $2.8 billion in sold volume, a 7.12 percent dip over the previous year.

Located to the west and south of New Hanover, the county saw a 20% drop in the quantity of sales to 7,844. However, the average price per square foot soared 114% to $446. By comparison New Hanover County’s price per sold square-foot average was $265, and Pender’s was $224.

Of the eight beach towns in Brunswick County, Ocean Isle Beach and Bald Head Island vied for top sales in 2022. Each hamlet had nine homes in the top 20, with Ocean Isle claiming the top two spots.

The No. 1 residential sale was 355 W. First St. in Ocean Isle. The 6-bedroom, 6-bath, 5,575 sf furnished home built by local custom builder Ernie Crews in 2010 was sold by Kylie Uzzell Parkhurst of Treasure Realty for $4,075,000 in September, 23% less than the previous year’s top sale.

The master suite encompasses the entire third floor.

“The house was in immaculate condition. Everything from the roof down to the geothermal system was so well thought out. And all the furnishings were handpicked; they had a place and had a meaning. I walk into a lot of houses and some feel like they’re worth a couple million and some don’t. This one definitely felt its worth,” Parkhurst says.

She noted that 2022 was a very powerful real estate market from start to finish. Brunswick County continues to see a rise in occupancy from north to south. Currently home to 133,789 people and encompassing 1,050 square miles, there is a great deal of undeveloped property and new construction abounds. While there may be pockets of shortages in niche markets, as a county there is inventory for sale.

“A lot more people are being drawn to it because of its quiet nature and the pristine beaches. Ocean Isle in particular has a very peaceful feel with the way the sun rises and sets,” Parkhurst says.

Homes in Brunswick remain a bargain compared to other beach properties.

“Even at the price point this house was at, it would be double if on Figure Eight Island or other places. It is the perfect little niche. You are buying a property that has a lot of potential to increase its value and you are in a spot that is not fully discovered yet,” Parkhurst says.

Getting away from it all and the golf are the main selling points of properties on Bald Head Island, which can only be reached by a 20-minute ferry ride or personal watercraft. No vehicles other than golf carts and bicycles are allowed on the 5.86 square mile island.

The properties tied for third were listed and sold by Wendy Wilmont Properties (WWP). Both houses sold for $3.8 million, one in May and the other in September.

WWP broker Ginger Dunn notes that the upswing in Bald Head Island purchases dates to 2020 as people fled crowded areas.

“We were stampeded by parents buying for their children. Kids were stuck with computer classes in the day, then they could play on the beaches in the afternoon. We witnessed a lot of families doing that,” she says.

Other island towns did as well.

The influx of families escaping Covid was a boon for the island. What were second homes became occupied by fulltime residents. The trend continues, but the inventory is very low. Even the purchase of a boat slip at Bald Head Island has become hard to come by.

“You can’t find a boat slip. We sold every boat slip we could get our hands on in 2021 and that made the market go ridiculously high,” Dunn says. “A 100-foot slip sold for $630,000 in 2022.”

When the 4-bedroom, 4-bath home at 976 South Bald Head came on the market, Dunn’s buyers got it on day one. The other home selling at the same price, located at 220 Station House Way, is a 5-bedroom, 6.5-bath home with an ocean-facing fully covered porch. It was on the market for two months.

One hundred and seventy-three Realtor-assisted sales on BHI totaled $129,247,047. The average sold price was $747,000, the median was $410,000, and the average sold price per square foot was $495, while the average sold-to-list ratio was 94%. The high sold-to-list ratio was $1,508 per square foot.

In 2021 Bald Head saw $185,326,650 in closed residential sales.

Rounding out the top five in this county was 9225 Peakwood Drive in Calabash. The 7-bedroom, 4.5-bath home, built in 1994 by Jeff Skelly of Nations Homes II, offered a whopping 8,800 heated sf home and sold for $3.6 million in May. The new buyers are just the second owners.

“It is gorgeous inside and out. It exudes pure Southern grace,” says broker Diane Dalen of A Pearl in a Shell.

The home boasts a gym and sauna and a separate pool house with full bath. Grand brick stairs in front make it look like a governor’s palace.

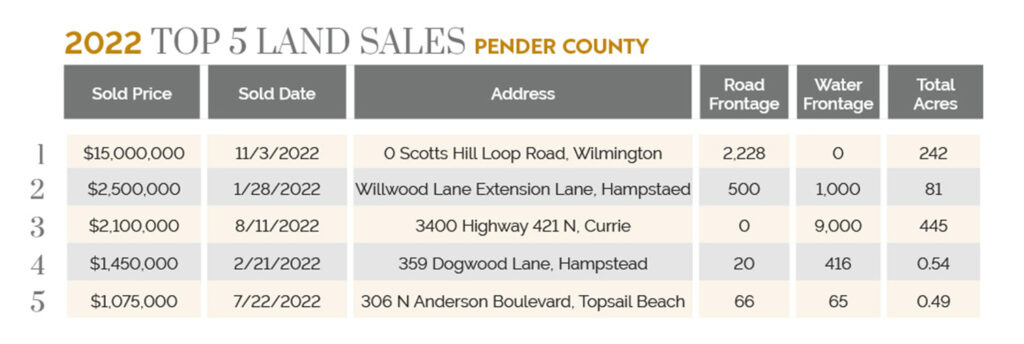

Pender County

By Fritts Causby

The pace of sales in Pender County moderated in 2022, with a dip in overall sold volume of 3.45 percent, as buyers grappled with interest rates that were nearly double what was available the year before. As elsewhere, multiple offer situations and homes selling for over asking price were no longer the norm.

“It definitely was in transition because of the external factors that were in play: rising interest rates and the limited inventory coming into the system,” Dean Phillips, Landmark Sotheby’s, says.

“A lot of sellers were playing wait and see. Throughout history folks have been able to buy and sell to be able to upgrade. They were saying, ‘Yes, I can make some money,’ but with the limited inventory they were afraid they would have nowhere to go. The buyer activity has slowed too, because of the higher interest rates. Many would be leaving a 2% mortgage, to grab a 5 or 6% mortgage. It definitely put the brakes on the market.”

However, the days it took to sell a home decreased by 23%.

Realtors in Pender say the ongoing lack of supply and continuing strong demand from buyers kept the market stable. The average sold price increased more than 21%, and the sold price per square foot increased 16%. The median was up 20%.

“Pender is two markets,” says Dean Phillips. “You have your primary inland, and you have your second home beach market out on Topsail Island. Some people on Topsail were selling their second homes just to take advantage of the higher sold prices.”

Only three of the top 10 home sales in Pender County were oceanfront properties. Dawn Berard, broker/owner of Sold Buy the Sea Realty, represented the seller of one of the more unique offerings, a sprawling estate compound on five acres, complete with an approximately 5,100 sf main home and room for five horses.

“Homes with five acres or more in coastal North Carolina are definitely few and far between,” Berard says. “In 2022 there were over 1,900 single-family homes sold, not including townhomes and condos. Only 76 of those had more than five acres. If you narrow that down further to the true coastal cities that touch the Intracoastal Waterway, there were only 30 with over five acres and even less with usable acreage.”

The residence, located in the Whitebridge neighborhood, includes a guest house, saltwater pool, and workshop. It closed at $1.75 million after spending 21 days on the market.

Beth Dudley, a broker with Lewis Realty, has a similar perspective on the value of coastal North Carolina real estate.

“Compared to other states, it’s still reasonable here. People have just really fallen in love with our coast,” Dudley says. “I’m seeing more people drawn to the coast versus other areas.”

Dudley, who has lived in California and Tortola, represented the seller of 438 Beachwood Ave., a sound-front home located in the live oak area of Topsail Beach. The house is located on three separate parcels and includes a private dock, boat lift, and five bedrooms. It closed at $1.9 million after spending 98 days on the market.

“I don’t feel like we’ve priced ourselves out yet. I think there is a lot of value here. Of course, anywhere there’s water and a coastline, there’s always going to be people wanting that,” says Dudley.

Agents that work in the luxury segment of the marketplace say that even if prices moderate and the economy goes into a recession, homes in the upper tier may not be affected much since most are cash deals.

Pleasure Island

By Taylor Hammeke

Real estate in Pleasure Island, encompassing the towns of Carolina Beach and Kure Beach as well as Fort Fisher, was anything but stagnant in 2022. The island saw the least percent of decrease in its overall sold volume of the three-county area, 1.7%. However, there was a 21% decrease in the number of properties sold, which paralleled other local trends.

Following the nationwide trend, housing prices continued to increase. Several Realtors said there were more cash sales than in previous years.

Berkshire Hathaway agent Leslie McIntosh says there was more demand for the luxury market in Carolina and Kure Beach, which historically hasn’t seen those prices.

Sold price per square foot was up 23%. The average and median sales prices were up 78% and 49% respectively.

“People are really wanting to be here, and are willing to pay a lot for a single-family home” says Jessica Keenan with Nest Realty.

Eric Knight, a Nest Realty agent, had a noteworthy sale in Kure Beach, 902 Fort Fisher Blvd. North Unit A, which closed at $1.7 million on Nov. 14. The oceanfront property broke the 2022 record as the highest sale of a dwelling with a shared wall on Pleasure Island by about $400,000.

Greg Wallace with Barber Realty Group had a notable sale of an oceanfront lot in Carolina Beach, 1523 Lake Park Blvd. South, which closed on Nov. 15at $1.25 million. It was one of the few available undeveloped oceanfront lots from Brunswick County up to Figure Eight Island.

A selling point for Pleasure Island is the quantity of homes with views of or convenient access to the water. Houses typically categorized as interior, several blocks from the ocean, had seven sales of over $1 million, which is not typical of these island communities.

There were many buyers from the Raleigh and Charlotte areas purchasing property on Pleasure Island to enjoy on the weekends. Investment was also a prominent theme, with buyers seeking multi-unit properties for seasonal vacation rentals.

Casey McKinney, a broker with Intracoastal Realty, says 2022 had more new construction than the previous five to 10 years.

Older motels are being remodeled. A 12-room hotel at 205 Harper Ave. sold for $1.85 million by Ea Ruth with The Property Shop International Realty on May 12, with the new owners intending to make updates.

A few new townhome communities are also in progress in Pleasure Island. A trend that likely lends to the volume of new construction was the cost of lumber dropping in the second half of the year, which also led individual buyers to snatch up lots to build their forever home.

Sharon Stout with Coldwell Banker had the highest selling residential sale in Pleasure Island, 205 and 211 Spartanburg Ave. in Carolina Beach, which sold for $3.25 million on Nov. 28.

“The Pleasure Island community has a small-town feel and is getting more modernized,” Stout says.

“In a lot of ways, you can liken Wilmington to Wrightsville Beach. The dynamics are very similar. Wilmington cannot sprawl anywhere but north in regard to housing,” Ace Cofer, a Wrightsville native, says. “We’ve got a river on our west bank and ocean on our east bank and geographically, New Hanover County is like a peninsula. We’re not an island like Wrightsville Beach or Figure Eight, but we’re surrounded by water on three sides. We start to get into the scarcity of not just real estate inventory but scarcity of earth. New Hanover County is starting to look a lot like rare earth to a lot of those who want to live here.”

Cofer also serves on the Wilmington Planning Commission.

“The principles today are fundamentally different from what they were when we woke up Jan. 1, 2009. Everyone that’s been run through the lending system from 2009 until today, have had full income and asset verification,” Cofer says.

No one can predict the future but the market is still strong.

“Even if there’s some softening, when your property has appreciated 2% a month for 24 months you’ve climbed the summit, you’re at the top of the mountain in the high altitudes. Even if you take one or two steps back down the mountain, you’re still leagues away from base camp. Even if there’s a little softening, I think everyone’s going to be OK,” Cofer says.

All overall sold numbers represent sales of all property types from 1/1/2022 to 12/31/2022, and are sourced from NCRMLS. The information is deemed reliable, but is not guaranteed.