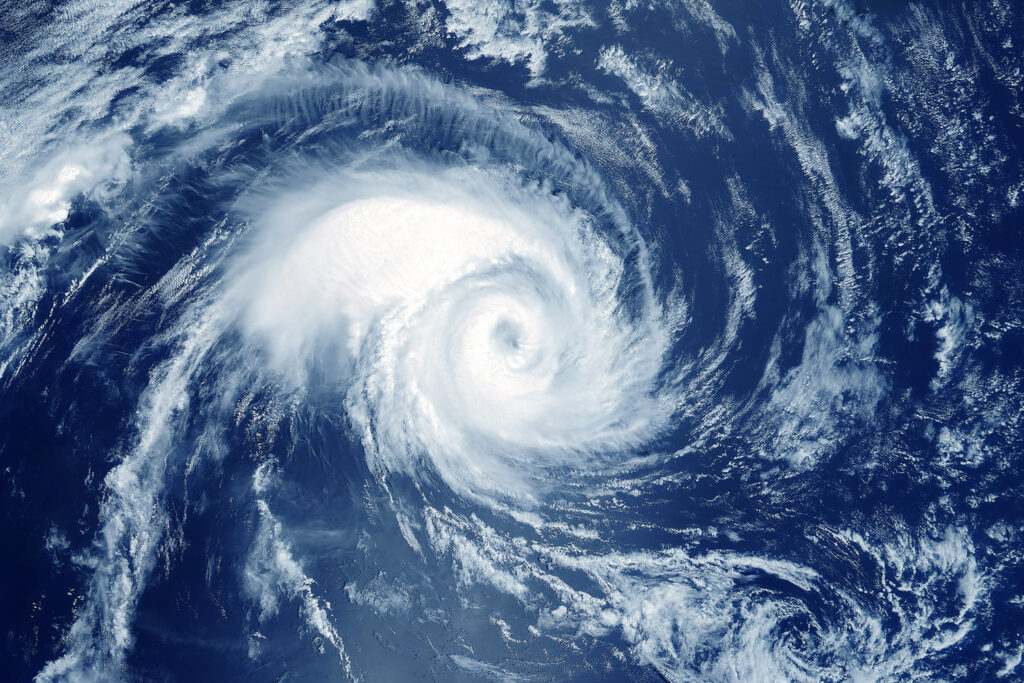

Get Ready for Summer Storms and Hurricane Season

Checking and updating flood insurance policies is recommended

BY Lisa Sharrard

Atlantic hurricane season officially runs from June 1 to Nov. 30. In preparation, remember that Mother Nature does not always abide by this time frame. Coastal North Carolina has experienced storms before and after those calendar dates.

In anticipation of hurricane season, property owners should review and update all building and/or contents flood insurance coverages and replacement cost values with an agent.

Inflation has driven up the cost of repair and replacement, so homeowners will need to ensure they have sufficient policy coverage to address their potential needs. This applies to both homeowners’ insurance and flood policies. Flood policies require that the building coverage be 80-100 percent of the Replacement Cost Value (RCV), up to the maximum of $250,000 under the National Flood Insurance Program (NFIP), to pay out replacement cost at the time of a claim. Under the NFIP, contents coverage is confined to Actual Cash Value (ACV).

Additionally, walk through the property and take photographs. These should include make, model and serial numbers of appliances and mechanical equipment. Open closet doors and seldom used spaces when conducting the walkthrough and capture images or video, which will help in the event of a claim. The advantage lies in completing this before the season starts, as waiting until the storm hits or an evacuation is ordered will only cause delays and anxiety.

Save receipts and records of major household purchases of appliances, furniture or specialty items. Check with the agent to see if purchasing additional coverage is needed for any of these items above the standard policy limits. With online shopping and smartphones, this is easier than ever. All that is needed is to snap a clear photo or scan the receipts, save in a convenient location, and back up the data.

Many condominium owners do not realize they can purchase and benefit from a policy that can provide not only flood coverage for repairs to their individual unit, but also covers Condominium Loss Assessments caused by flood damage to condominium association-owned properties. If the NFIP policy insures a unit, the policy will pay up to the coverage limit of liability for your share of loss assessments charged against you by the condominium association (above their deductible) in accordance with the condominium association’s articles of association, declarations, and your deed, less any deductible. We have seen NFIP pay out claims of $18,000 or more to cover condominium assessments of unit owners. Under Risk Rating 2.0, the floor the unit is located on is a rating factor, thus making policies more attractive in some instances.

Private flood policies may have different policy terms and conditions. Always refer to your policy for specific language regarding coverages.

Lisa A. Sharrard, CFM, CPM, ANFI, is the owner of Choice Flood Insurance. Before entering the private sector in 2010, she served as the NFIP Coordinator for the South Carolina Department of Natural Resources. At FEMA’s invitation she had input into Risk Rating 2.0.

Pro-Active Preparation

NATIONAL Flood Insurance Policies (NFIP) provide “loss avoidance” coverage. Per the fine print in the policy, the NFIP will “reimburse certain actions you take to minimize damage to your home and belongings before a flood. You may be eligible for reimbursement up to $1,000 for materials to protect the property and up to $1,000 to move insured property away from an imminent flood,” not to exceed the policy limits. There is no deductible and filing a claim for loss avoidance alone will not count as a claim toward repetitive losses.

Go over the specific language in an individual policy. Specifically, the standard NFIP Dwelling policy form allows for:

A. Sandbags, Supplies, and Labor

(1) Up to $1,000 for costs you incur to protect the insured building from a flood or imminent danger of flood, for the following:

(a) Your reasonable expenses to buy:

(i) Sandbags, including sand to fill them;

(ii) Fill for temporary levees;

(iii) Pumps; and

(iv) Plastic sheeting and lumber used in connection with these items.

(b) The value of work, at the federal minimum wage, that you or a member of your household perform.

(2) This coverage for sandbags, supplies and labor only applies if damage to insured property by or from flood is imminent and the threat of flood damage is apparent enough to lead a person of common prudence to anticipate flood damage. One of the following must also occur:

(a) A general and temporary condition of flooding in the area near the described location must occur, even if the flood does not reach the building; or

(b) A legally authorized official must issue an evacuation order or other civil order for the community in which the building is located calling for measures to preserve life and property from the peril of flood.

B. Property Removed to Safety

(1) We will pay up to $1,000 for the reasonable expenses you incur to move insured property to a place other than the described location that contains the property in order to protect it from flood or the imminent danger of flood. Reasonable expenses include the value of work, at the federal minimum wage, you or a member of your household perform.

(2) If you move insured property to a location other than the described location that contains the property, in order to protect it from flood or the imminent danger of flood, we will cover such property while at that location for a period of 45 consecutive days from the date you begin to move it there. The personal property that is moved must be placed in a fully enclosed building or otherwise reasonably protected from the elements.