Real Estate Roundup

Home buyers demonstrate there’s no place like home — especially during a pandemic

BY Christine R. Gonzalez

Few could have scripted the wild ride area real estate took during the pandemic of 2020. Coming off a robust 2019, the market looked strong and started at a good pace. Then stopped. Then skyrocketed.

“If you told me in the spring that we would have the year that we had, I never would have believed you,” says Michelle Clark-Bradley,broker with Intracoastal Realty. “Everything just shut down in March and April, even well into May, then Memorial Day weekend everything opened up and we made up for lost time very quickly.”

While life as we knew it continued to shift seismically, the real estate market roared from zero to 100 mph quickly.

“We went from no or very few showings to you put it on the market and you might be getting multiple offers over asking price within a few hours. It has gone from one end of the spectrum to the other for sellers,” Clark-Bradley says.

Other Realtors echo the pattern of a good start, a near stop, and then a flurry of buying brought on, they say, by the uncertainty of what the future would hold.

“2020 started off with a bang, but the COVID outbreak in March stopped the market in its tracks,” says Vance Young, broker also with Intracoastal Realty. “Honestly, I thought we were looking at a 2008 market, which was a sobering experience for anyone in the real estate industry.”

It proved to be the opposite.

“Most election years, buyers will sit on the sidelines, but the COVID phenomenon pushed buyers to upgrade their homes and to buy second homes,” Young says. “The result was our best year ever, especially in the high-end market locally.”

New Hanover County had $2.5 billion in closed brokered sales, a 31 percent increase over 2019. Brunswick County saw a 50 percent jump in closed sales, while Pender County logged a 44 percent increase.

The top sale in New Hanover County was $5.5 million, a 10 percent increase over last year. Four homes matched or bested the highest New Hanover County residential sale of 2019, which was $5 million.

At 3.2 million, Brunswick County’s top sale was 45 percent more than the previous year, however Pender saw an 8 percent decrease.

“All of the beach markets in the region, from Ocean Isle Beach through Brunswick County, New Hanover County beaches and on up into the Topsail area have all been on fire this year,” says Nick Phillips founder and principal broker of Landmark Sotheby’s International Realty.

The flight to “refuge markets” from big cities was huge and spurred in part by more people working from home.

“There is a seismic shift in the way corporations do business and people who can work from anywhere are coming to our area,” Phillips says. “Companies large and small have now realized they don’t need their teams to work inside office buildings to be productive. The pandemic also reminded people of the value of a second home as a refuge for their family.”

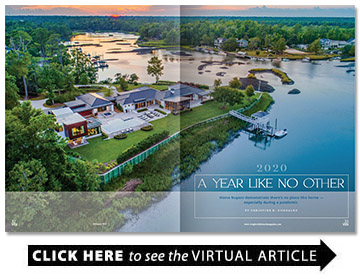

Phillips closed the No. 2 New Hanover County sale of the year, a waterfront estate on Futch Creek Road in Porters Neck built by Lending Tree CEO Doug Lebda. It sold for $5,277,000. The 3.6-acre home site is uniquely situated on a knob in the creek. Surrounded by water on three sides, it enjoys sunrise and sunset views. The property was previously owned by the late Episcopal bishop of East Carolina, Thomas Wright, and his wife. The new home Lebda built on the site in 2014 retained the double-sided fireplace they enjoyed. The property includes a 2,000 sf guest house and saltwater pool.

“It was only on the market for a few days before a Raleigh tech CEO purchased it as a retreat property,” Phillips says.

Two key phrases define the 2020 market: home refuge seekers and primary-secondary home buyers.

“We have really seen people wanting a home refuge,” Coldwell Banker Sea Coast Advantage broker Jessica Edwards says. “People wanting to have a space to work, play and unwind all in one space. And if you have children, that adds a whole other level; people are thinking about homeschooling. We’ve seen an increase in clients wanting a true home office space.”

Edwards explains the “primary-secondary home” phrase as, people who are “looking for a primary home now but have thoughts in the back of their head that, if they return to cities, it could eventually become a vacation or second home.”

Intracoastal Realty broker Carla Lewis said she saw a lot of people ‘escape’ from the larger cities.

“They were coming down and quarantining here, after getting a sense of our community, they didn’t want to go. They were looking for security and a safe haven, so if this kept going on, they could feel at home and being around water, that kind of lifestyle just appealed to them,” Lewis says.

Luxury Ticket

Property sales were record-breaking in all price points, including the luxury market.

Trey Wallace, president of Intracoastal Realty, broke down the $1 million and over sales for New Hanover County.

“The county saw an approximate percentage increase in the following price thresholds: $1 million-plus homes were up 71 percent in transactions versus 2019 for a 2020 total just north of 200 transactions,” he says. “The $3 million-plus market saw a 77 percent increase over 2019 for a total just north of 20 transactions. The $5 million-plus saw an incredible 300 percent increase over 2019 for a total of four transactions.”

Three of those four top transactions were on private Figure Eight Island.

“On August 1st, there were five houses in the area that were for sale at $5 million or above and by September 1st, all five of them were under contract,” says Intracoastal broker Buzzy Northen. “That is why this summer was so extraordinary; these houses sold really quickly.”

Another facet of the wild 2020 market was the high ratio of homes sold at close to or above list price.

“It has been a record-breaking year in real estate in all price ranges,” Michelle Clark-Bradley says. “A lot of people were getting above their asking price, more than I’ve seen in my 15 years of experience in real estate.”

The New Hanover County No. 1 and 2 home sales, $5.5 million and $5.277 million respectively, sold for 96 percent of the listed price.

Wallace says the top 35 New Hanover County sales, which totaled $121 million, averaged 95.19 percent of list price. The average price per square foot for these sales was $778 per square foot. The highest price per square foot was $1,575. The median days-on-market was just 55 days.

The strong market happened despite pandemic constraints, including restrictions on in-person showings.

“Sellers didn’t really want people in their homes,” Clark-Bradley says. “There was just so much uncertainty and that created fear. That’s really why things stopped and showings declined.”

Realtors adjusted by using technology.

“We saw an increase in virtual tours and FaceTime appointments as a result of COVID and a heated market,” Vance Young says. “There were a number of clients that could not come to town quick enough to see a property before it went under contract. I had a wonderful couple from England that bought a house off Airlie Road sight unseen. They had family in the area, so I met the local family at the house and we FaceTimed with the buyer in England. It’s great because I pass them on my morning walk around the loop nearly every morning (they’re running) and they are very happy here!”

Figure Eight Island Lands Top Sales

The top 2020 home sale for New Hanover County was at 142 Beach Road South on Figure Eight Island. The 7-bedroom, 5,877 sf oceanfront home on a double lot was listed and sold by Buzzy Northen in October for $5.5 million. It included separate 624 sf guest quarters, and garage space for five vehicles.

Out of the top 35 residential sales in New Hanover County, 49 percent or 17 homes were on the island.

Figure Eight saw a staggering 82 percent increase in sold volume, and a 60 percent increase in properties sold. The median sales price increased 19 percent.

“2020 was a year unlike any other,” Northen says. “By early May, all second homes all over the country were in great demand. People wanted to get away from large cities. Places like Wilmington and beaches were sought after destinations to get away from COVID. The fact that Figure Eight is private is a factor. It gave everybody a feeling of safety, or a safe place to be. In my opinion, it has been the strongest real estate year in history. I’m talking about all of Carolina, the whole area. People are trying to upgrade their homes because they are much more important to them than before COVID.”

The buyers of 142 Beach Road South were a young couple who wanted to move south.

“They were selling a property in the Northeast for a dramatically higher price than what they paid for the nicest oceanfront house in Figure Eight,” Northen says.

Inventory on the island is the tightest it has ever been.

“Eight years ago there were 42 houses and seven lots for sale at Figure Eight. At the end of 2020 there were three houses and two lots,” says Northen.

“We have been battling more demand than supply, we battled that in 2019,” says Figure Eight Realty broker Kirra Sutton. “That wasn’t anything new. It just progressively got worse, because why would you sell your second home (during a pandemic), and why wouldn’t you want one right now?”

Like Northen, Sutton said most of her clients are cash buyers, but the low interest rates make financing more attractive.

Figure Eight Island is known to be frequented by VIPs. Among the celebrities reported to have leased and rented there are Dustin Hoffman, Dan Aykroyd, Kim Basinger, Alec Baldwin, Gwyneth Paltrow, Tom Cruise, Nicole Kidman, Jennifer Aniston, Robert Downey Jr., Macaulay Culkin, former Vice President Al Gore, and the band OutKast. TV star Andy Griffith once owned a home on the island.

The home at 188 Beach Road South, which sold in October 2020 for $5 million after sitting on the market for about four years, also has some celebrity. The 9,000 sf home, built in 1987 on 7.9 acres at the island’s extreme south end, was designed by the late J.P. Goforth and was the background for the 2016 Julia Roberts thriller Sleeping With the Enemy. The house, fitted with marble throughout, languished on the market in part because some of its acreage is not actually Figure Eight Island, but is West Part Tract 3 Hutaff land.

Wrightsville Beach Market Flexes Muscles

Wrightsville saw a 39 percent increase in sold volume, with a 30 percent increase in properties sold. Days-on-market dropped 36 percent. The average sold price was more than $1 million. There were 10 lot sales totaling more than $16 million (see chart on page 52).

“The 2020 real estate market in Wrightsville Beach was nothing less than extraordinary,” says Luke A. Waddell, CEO of Cadence Realty. “We continue to see increasing values in our local market as remote work becomes the norm and buyers across the country clamor to get to the coast.”

Thirteen of the top 35 homes sold in New Hanover County were in Wrightsville Beach. Seven of those were located on Harbor Island, including three on North Channel Drive.

“As a whole, Wrightsville Beach has been very, very hot. It has been the strongest I remember since 2004,” Jessica Edwards says. “You see things selling at high prices and inventory going very quickly. We didn’t really see the lull we expected in the market. When everything shut down in March and everybody just kind of paused, there was an unknown. We really expected to see a slowdown in the summer months, but we didn’t see that.”

Three of the top 35 New Hanover County sales — Nos. 9, 15 and 16 — were in the north end’s tiny Duneridge Estates.

Taking the county No. 9 spot was the top sale for Wrightsville this year, 11 South Ridge Lane, a Hardee Hunt & Williams listing that Intracoastal Realty sold fully furnished for $3,895,000 in October. Built in 1994, the 5,000-plus sf oceanfront home occupies a 70-foot-wide, high dune lot with stunning north end views.

Hardee Hunt & Williams’ Broker-in-Charge Randall Williams, who has been in Wrightsville real estate for 38 years, says he has learned the hard way to never say “you’ve seen it all.” Inevitably, unanticipated events and circumstances occur that can substantially affect real estate sales and values.

Williams cited the wildly popular synthetic stucco, which rendered properties virtually unsaleable, and multiple hurricanes he thought would crush barrier island properties, only to see them rise.

“I saw prices virtually double over several years only to implode in 2008, wiping out billions of dollars of equity that has now taken a decade or more to regain. And now in the middle of a pandemic, we have an unanticipated demand for second homes nationwide, if not globally,” he says. “So yes, anytime you think you have seen it all in the real estate business, just wait awhile, because you probably have not.”

Wrightsville Condo Market

The condo market at Wrightsville Beach is made up of units in large condominium communities scattered about the two-island town, including oceanfront Duneridge Resort and Station One. Realtors are dealing with static inventories; these units were largely developed from the early ’70s to early ’90s. Barring massive redevelopment or rezoning, there won’t be any future development of this type on the island. Without competition, these condos remain relatively expensive.

“The demand for condos was brisk this year as it was for all other island properties,” Randall Williams says. “But despite brisk sales, and some surprisingly high prices ($1.65 million for one Wrightsville Dunes unit) we still have not seen a full recovery in condo prices on average since the bust in ’08.”

One reason may be that at this price point buyers often look at alternatives, like a second- or third-row single family home, or a townhouse. But as those property values increase, the condos remain attractive. They have the advantage of amenities, views and convenience.

Carla Lewis, broker with Intracoastal Realty, noted that anything in the condo market mainly sold in the first week with multiple offers, especially the ocean front properties.

“A lot of people who are buying second homes want a place where they can lock and go. A condo with all its amenities, and a lot have pools and tennis courts, it allows owners that freedom where they feel they can lock it up and leave,” Lewis says.

“The level of modernization of a particular unit is one of the biggest components of its value. As long as homeowners’ associations maintain their infrastructure, the condominium market will remain relevant indefinitely,” Williams says.

Inbound

While many purchases were by North Carolinians, Realtors report home buyers are fleeing large metropolitan cities all over the U.S.

“We continue to see an influx of not only second home owners but primary residence buyers moving to the coast,” says Nick Phillips. “We’ve seen buyers from North Carolina and most all of the major East Coast metro areas. But we have also seen buyers coming in a much bigger way from across the Midwest and even the West Coast. I had multiple buyers of beach homes from California this year, which is a new trend.”

Intracoastal Realty’s Laurie Carpenito confirms the movement from the North.

“There has been a lot of relocation from the New England area, and with people being able to work from anywhere they are choosing Wilmington,” she says. “You’ve got a small-town vibe, a cool little downtown, and you’ve got gorgeous beaches. It doesn’t get any better than that. There just aren’t enough houses on the market for the buyers that are here.”

Vance Young reports seeing buyers from Raleigh, Durham, Chapel Hill and the Northern states.

“I’ve had a number of buyers from the East Coast, from northern Virginia to Connecticut, who have bought second homes here rather than Florida because they can drive here much easier and are averse to flying with the COVID scare,” he says.

Jessica Edwards agrees.

“We are still seeing locals purchase, but especially at the higher end in luxury homes we are seeing buyers come from larger metropolitan areas, buyers from New York, D.C., Atlanta, different areas,” she says. “But also local people are wanting more space to just be home and be able to live, work and play in that space.”

Landfall Sales Drive Inventory Lower

Landfall experienced a robust year, with 51 percent higher sold volume in 191 total transactions, while inventory was down 40 percent.

“In general, the inventory in Landfall is very low, historically low,” Michelle Clark-Bradley says. “There are only 35 homes for sale in Landfall currently [as of December 2020]. In a normal year, we’re seeing about 100 on the market at any given time.”

The top sale in Landfall was 1121 Pembroke Jones Drive, listed and sold by Clark-Bradleyfor $3,050,000 — an 11-percent increase over the high in 2019. The 6-bedroom, 7,806 sf waterfront home, built in 2003, took No. 21 on the New Hanover County sales list.

“Turnkey is more desirable than building right now when it comes to second homes,” says Nick Phillips. “Folks don’t want to have to wait. So if they can walk in the door and it is furnished and they can begin using it right away with their family, that is always ideal.”

Downtown Wilmington

By Amanda Lisk

There were 122 Realtor-assisted sales in downtown Wilmington in 2020, matching the number from the previous year. Those sales saw a $1 million increase in total sales volume; $25.7 million for 2020 compared to $24.7 million in 2019.

Nearly half of the downtown closings were for River Place, a new waterfront luxury high-rise condominium located on Water and Grace streets overlooking the Cape Fear River.

Seventy-six condos and/or apartments closed there in 2020, many of which went under contract in 2019 and closed upon completion of the 13-story building. The top sale was a penthouse, which sold for $1,035,000 in July.

“River Place has created a lot of confidence in downtown Wilmington, it’s spurred on other developments and renovations of buildings,” says Keith Beatty of Intracoastal Realty, the lead broker for the condominium.

Other significant downtown sales include the McClammy-Powell House, a circa 1914 neoclassical, brick revival on South Front Street in the heart of the historic district, which sold for $990,000 in January.

The original owner was Richard McClammy, editor and publisher of the Evening Dispatch. Grocer Carl Powell and his wife, Edith Corbett Powell, purchased the home in 1948.

A unique three-story, free-standing building on Water Street in the Chandler’s Wharf area, designed for mixed-use, sold on April 6 for $925,000. The building at 219 South Water Street was originally a one-story brick warehouse, part of the Hanover Iron Works Complex.

Sam Simmons, owner of Port City Properties, was the listing and selling broker of the building and also the previous owner.

Simmons designed the renovation and addition on a napkin while at dinner when he purchased the warehouse in 2008. With the help of an architect, Simmons preserved the historic brick outer shell and built up to create a three-story mixed-use building. The top floor is a penthouse apartment. The first and second floors can be used for either residential or commercial space.

“People really want to be downtown, there’s a vibrant scene here, people like that they are able to walk and dine,” Simmons says.

Simmons says affordability in downtown compared to other areas of Wilmington is playing a role in downtown growth.

“Things that are priced fairly are getting a lot of interest,” he says. “Many of the sales I was involved in had competing offers. My last closing of the year had six offers.”

Beatty says River Place closings were primarily for residents coming from a 45-mile radius, as well as a few moving in from bigger cities such as New York City and Chicago.

“With the opening of the park and amphitheater in the spring or summer [North Waterfront Park], that will really be a catalyst for future development and housing and vibrancy for the downtown area,” Beatty says.

COVID-Induced Exuberance

Counterintuitively, the 2020 real estate market was one of the strongest ever

Opinion by Randall J. Williams

A virus ravages the globe. Our nation endures social upheaval and acrimonious polarization not seen since the 1960s. We stifle the hottest economy in years with a self-inflicted wound. We suffer through one of the most miserable presidential campaigns on record.

The flying class, which jumps on airplanes like millennials jump in an Uber, is suddenly grounded. High-tech, Class A office space sits vacant while the lucky-to-be-employed video-conference from home in their jammies while drinking lattes. Desperate service workers languish while politicians who never miss a paycheck bicker over how to firehose another trillion dollars into a hobbled economy to mitigate this fiasco.

And yet, somehow it manifests itself as the hottest real estate market since the ’05-’07 boom. Go figure.

I’m just a Realtor, not an economist. But if you coop people up long enough in a stressful environment, combined with very low interest rates and copious liquidity coursing through the system, and you mix in ample angst, you might find yourself in a hot market.

It confirms to me that residential real estate, as an asset class, has an intrinsic appeal to people on a visceral level not necessarily driven by reason or quantitative analyses. Emotion becomes an integral component of its valuation. Its tangibility only reinforces its desirability.

Ownership is powerful.

I would predict that it’s going to rock on into the first quarter.

Randall J. Williams is the Broker-in-Charge at Hardee Hunt and Williams Real Estate.

Pender County

By Fritts Causby

The numbers point to the strength of the market in Pender County, where the 2020 sales volume increased by more than 44 percent over 2019. Units sold grew by more than 25 percent, and the average sales price increased by nearly 15 percent, to $308,880.

The number of active listings in the county shrunk by nearly 38 percent, while the number of pending sales witnessed an uptick of almost 108 percent.

“While we thought 2020 was going to be a normal, busy year, it certainly wasn’t normal or busy for several weeks, then it was like a dam burst and it turned out to be one of the more robust years on record,” says Frank Sherron of Landmark Sotheby’s International Realty.

Multiple-offer situations and homes closing well over asking price were the norm.

“We were working 12 to 14 hours a day, seven days a week, for most of last year,” notes Savannah Holman of Coldwell Banker Sea Coast Advantage, who mainly serves military buyers and sellers in Pender County. “With the low interest rates, people are buying second homes and investment properties. Also, many are realizing that it can often be cheaper to purchase than it is to rent.”

The lower price points saw the most activity, but the luxury segment also surged higher.

The number one sale in Pender County was at 464 N. Anderson Blvd., a mid-century modern built in 1952, set on a high bluff with 128 feet of frontage on Banks Channel. Though it is not oceanfront, it has deeded access to a private beach. Renovated in 2015, it closed at $2.3 million after being listed at $2.599 million and spending zero days on market.

The only top sale not on a barrier island was 610 Holly Hill Road in Hampstead. With a 5,500 sf main house, a 17-acre farm, and 775 feet of frontage on Virginia Creek, it was described as a “waterfront equestrian estate.” It closed at $1.66 million, a number that seems low in comparison to other markets.

The sale of oceanfront vacation rentals at 122 N. Shore Drive and 124 N. Shore Drive was also interesting, as these nearly identical properties were reported as fetching over $225,000 in income in 2019. One closed at $1.925 million; the other closed at $1.85 million. Both were all-cash deals.

Brunswick County

By Fritts Causby

As with Pender County, most of the top sales in Brunswick were oceanfront. Most were all-cash deals, but more luxury buyers utilized conventional financing than ever before.

“Money is cheap right now,” says Stephanie Blake, a broker with Intracoastal Realty on Bald Head Island. “People have been able to afford to borrow and keep their capital.”

Blake also indicated there were more sales over $2 million in 2020 than the previous five years combined.

People were buying large vacation homes instead of going on expensive vacations overseas. Many of the luxury buyers in Brunswick were from Raleigh, Durham and Charlotte.

“People are looking for that safe space, a place to vacation that is not too far away to drive to,” Blake adds, referencing the impact of COVID-19.

The top sale in Brunswick County was 218 Station House Way, a 5,567 sf oceanfront home on Bald Head Island that closed at $3.2 million.

One of the more unique offerings was the creek- and oceanfront home at 1405 W. Main Street in Sunset Beach, with a 5,175 sf interior, 1.02 acres, and redwood siding. The home closed for the full asking price of $2.995 million, in an all-cash deal, after just 13 days on the market.

The only other top sale in Brunswick not on Bald Head was an Ocean Isle vacation rental. The 12 bedroom/12 bath property at 50 E. First Street closed for $2.45 million after spending 49 days on market.

“People who purchase in Ocean Isle are looking for an investment that they can actually use, a place that will allow their family to enjoy the beach, but that will also bring substantial income,” says Sarah Harris of Intracoastal Realty.

The average sale price in the county increased by 16.25 percent, but this did not slow the pace of sales. The sales volume in Brunswick showed a nearly 50 percent increase from 2019, while the number of active listings decreased by nearly 30 percent, and the number of pending sales rose by almost 82 percent.

“Sales went the opposite direction of what we anticipated with COVID,” Blake says.

The numbers are in line with what the rest of the country witnessed over 2020. There was 22 percent less inventory versus the same time a year ago, and median home prices across the United States rose by 14.6 percent, to $310,000.

Pricing on the Rise

On a national comparison, luxury home prices on the Carolina coast are considered low.

“An incredible oceanfront home can be purchased for pennies on the dollar here compared to other luxury, more metropolitan beach towns such as Newport Beach or West Palm. A $4 million oceanfront home on Figure Eight or Wrightsville would push $8 to $20 million in other ‘discovered’ towns, ones that are arguably less friendly and less charming,” Trey Wallace says.

“I believe that our luxury market here is just beginning to hit its stride. The prices are going to go up,” says Nick Phillips.

Carla Lewis said all property is selling for higher prices. She noted a tear-down on Pelican Drive selling for over $3 million.

“Second row, third row, everything is hot,” Lewis says. “If you can fit a couple of beds in there, some kids, and you can walk to the beach, it is a popular property. Even on Harbor Island, small homes are selling for close to a million dollars. That’s not happened ever, I believe.”

The Age-Old Battle

The battle between supply and demand will continue to drive the market. The flight from the metropolitan areas shows no indication of slowing down.

“I expect the COVID phenomena to continue to push people our way,” Vance Young says. “More people will continue to work from home, and who wouldn’t want to live in a coastal town with a historic riverfront, great university, world class beaches, and mild four-season climate?”

For area Realtors, meeting the demand is challenging.

“We need more inventory for 2021. I would love to see more sellers putting their properties on the market, but the same forces that are bringing buyers here are causing fewer of our property owners to sell,” Nick Phillips says.

“I’ve been with Figure Eight Realty at least 22 years and my Broker-in-Charge has been on the island since the mid-80s,” Kirra Sutton says. “This has been the least inventory selection that either of us have ever experienced. Honestly, what we’re seeing, what all the beach communities are seeing, is the inventory is going to remain tight.”

The 2020 real estate totals presented are as of Jan. 4, 2021, for Realtor-assisted sales only. They do not include for sale by owner or non-Cape Fear Realtors member-assisted sales.