Gold By the Square Foot

WBM’s Annual Real Estate Roundup

BY Pat Bradford, Christine R. Gonzalez, Amanda Lisk, Fritts Causby and Jim McDonald

Pots of Gold

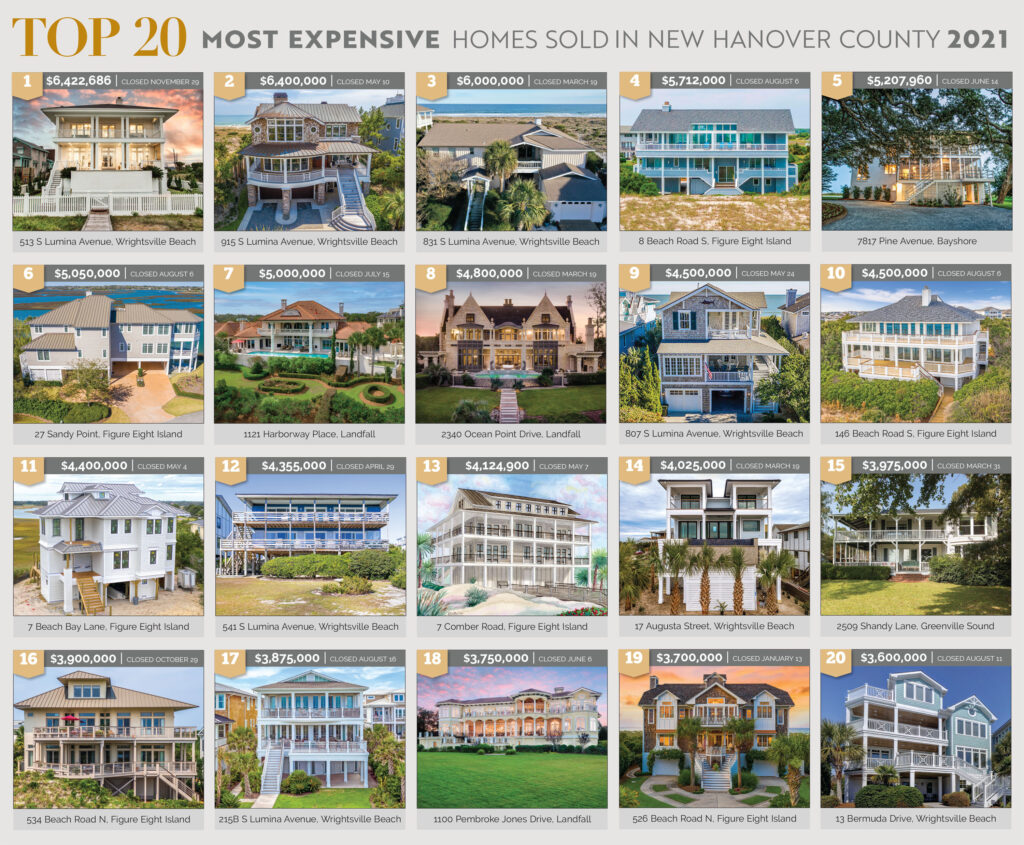

Wrightsville beach’s South Lumina Avenue had the top highest sales in New Hanover County with all three oceanfront properties bearing the well-known street address. Two were cash sales.

“The stock market’s been good, people have a lot of cash and if they want to buy something and they’ve got plenty of cash, they’re going to buy it and they’ll pay the price whatever it is,” Tim Milam CEO Coldwell Sea Coast Advantage, says.

All were purchased by local residents.

“These are not out-of-town cowboys coming through to purchase property. These are native Wilmingtonians, locals,” says Hardee Hunt and Williamspartner Ace Cofer. “It shows confidence in the market that these were not out of town purchasers. Second, it shows the wealth that exists in Wilmington.”

Closing in November, 513 S. Lumina, listed at $6,795,000, was the top sale in the three-county area at $6,422,686. The 4-to-5-bedroom, 6-bath home sits on 1.5 oceanfront lots. It was listed and sold by Vance Young, Intracoastal Realty Corp. The house previously sold in August 2017 for $4.25 million.

“That was typical appreciation over the past 4.5 years,” Young says. “That’s about 12 percent annually. We certainly can’t expect that every year, but it has been a solid stretch for the high-end homes in our market.”

Just four blocks south, 915 S. Lumina, after receiving multiple competitive offers, closed in May at $6.4 million, 100.2 percent of the list price of $6.25 million. The 4-bedroom, 5-bath home also sits on 1.5 ocean front lots, with 75 linear feet of ocean frontage.

“It also benefits from the adjacent vacant parcel, owned by the Army Corps of Engineers. Development of this parcel is possible, but unlikely. It affords additional privacy,” Ace Cofer says.

In between the two, the third highest-priced home, 831 S. Lumina, sold in March. It listed at $5.9 million and sold for $6 million. The home was built in 1972 on two oceanfront lots.

Ace Cofer says, “This sale closed 10 days prior to our contract on 915 S. Lumina. It established a $3 million value for 50-foot-wide oceanfront lots on the coveted south end of the island.”

Owned by the Virginia C. Trask family trust, it sold through Reagan Development and Trust.

“Some of these local purchases are a testament to families wanting to establish their legacy for generations to enjoy — on these $6 million sales, that was what was going on,” Cofer says.

In a real estate market driven by inflation hedging, supply chain disruptions, a health crises and politics, these sales stood out.

“It’s interesting that the three record-breaking sales on Wrightsville Beach were purchased by local Wilmington people,” says Vance Young. “They have traveled the world and know what a special spot we have. For them to invest in our area speaks volumes because they could’ve bought anywhere on the East Coast.”

Regardless of the driving forces, it was a runaway market.

“Never in my 34 years of selling high-end real estate in our area have I seen a market remotely like 2021. It was a spectacular year for both Wilmington and Wrightsville Beach real estate. People are making quality of life decisions and choosing to live, work, and retire where the quality of life is highest,” Vance Young says.

Of Wrightsville’s 165 sales through Realtors, 71 were more than $1 million. More than half of the million dollar purchases were cash sales.

“The luxury market rose almost 30 percent versus the year before, which is insane because 2020 was the best year for luxury that we had ever had. To then see it increase again by another 25-30 percent was just remarkable, especially over just one year, you see that type of growth over a decade sometimes,” says Trey Wallace.

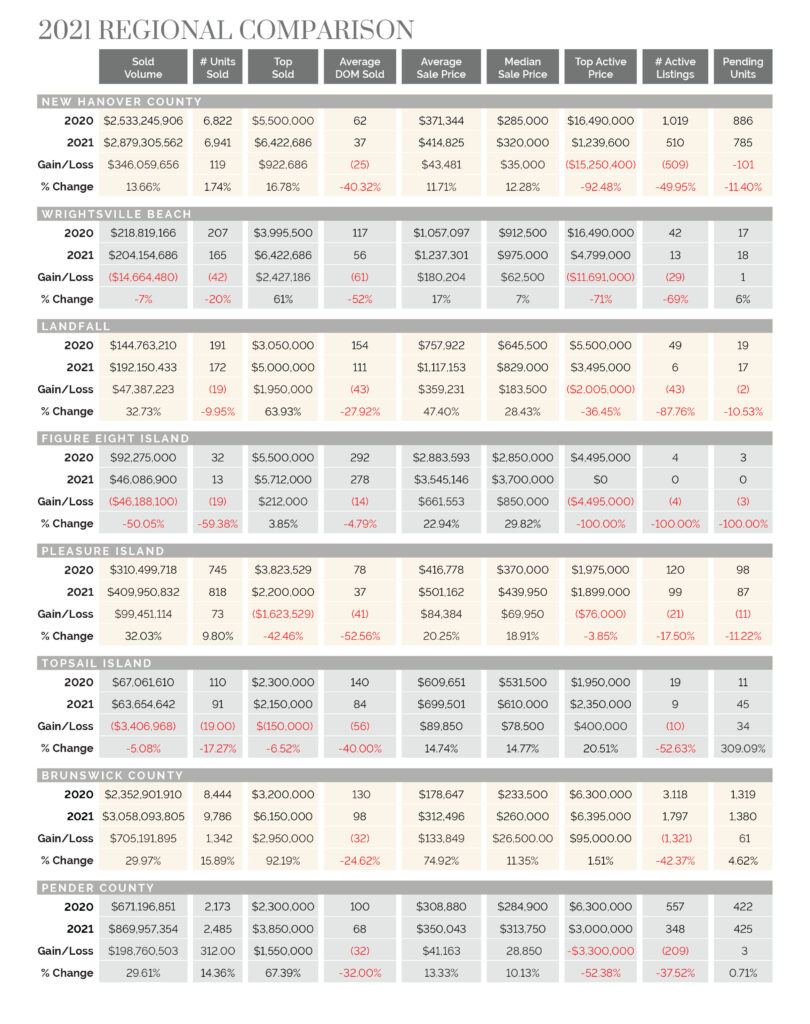

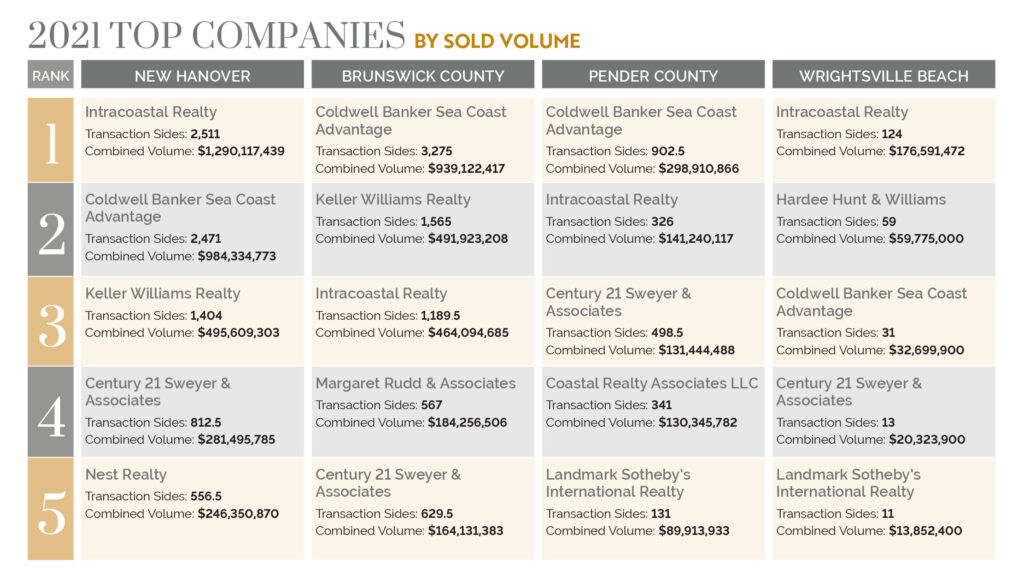

Realtor-brokered New Hanover County home sales saw a 14 percent increase in overall sold volume in 2021. But that was only a portion of the larger three-county story.

“It was an amazing year, an amazing market. Just like 2020, it was the best year in real estate ever, by the way most people would measure it,” says Intracoastal Realty president Trey Wallace.

Pender and Brunswick counties both experienced 30 percent increases in their overall sold volume, but their total sales numbers differed widely. Brunswick saw $3 billion is total sold volume through Realtors, while Pender County saw a more modest $870 million in sales.

Randall J. Williams of Hardee Hunt and Williams describes the red-hot market where lack of inventory drove prices higher, often in bidding wars as, “Too much money chasing after too few goods.”

The gated community of Landfall saw a 64 percent increase in its top sale, a 47 percent increase in average sales price, and a 28 percent increase in the median sold price.

On the four barrier islands, Wrightsville saw a 61 percent increase in the top sold, Figure Eight was just under 4 percent, and Topsail and Pleasure Island lost ground, with a 6.5 percent and 43 percent decline respectively in the high dollar sales.

Median and average sales prices saw gains everywhere, the highest at 74 percent in Brunswick County as buyers galloped to secure their piece of the gold.

“Currently, a confluence of factors is driving people to our area. Wilmington, while certainly on the map before COVID, is now on the national radar. Combine this with the fact that two hours up I-40, a major city is emerging. Developers, short on land, materials and labor, cannot keep up with demand,” says Williams.

Coming in Droves

Buyers seeking opportunity, looking to purchase as a hedge against inflation, or to improve quality of life are flooding the coastal area in record numbers.

“People are moving here in droves. For the last year we’ve seen it,” says Tim Milam.

With property scarce in Figure Eight and Wrightsville Beach, a door of opportunity is flung wide open for growth in other beaches.

“Other nearby markets are amazing, Topsail, Carolina Beach, Kure Beach, Sunset Beach, you know Bald Head has hundreds of lots left. There are tons of other beautiful beaches, and they are way less expensive, and some say they have more charm,” says Trey Wallace.

He likened the lesser developed area beaches to the way Wrightsville Beach was 15 or more years ago, he notes most don’t have that level of infrastructure outside of them. When you leave Wrightsville, you’re in Wilmington. When you leave these other beaches, you are in farmland.

All coastal towns are feeling the steep uptick in prices for land and homes, and there is a severe lack of inventory, especially in the island communities.

“The last two years have been pretty crazy. There are still fewer homes for sale now than there were a year ago. The last statistic I saw this fall stated there are less than half as many homes nationwide to sell than two years ago. Competition for the limited inventory is driving prices higher,” says Jessica Edwards of Coldwell Banker Seacoast Advantage.

In Landfall, a West Indies-inspired home at 2340 Ocean Point sold for $4.8 million, No. 8 in New Hanover County. The sale of the Intracoastal Waterway and oceanview home, a second home for the seller, was purchased by a second home buyer. Tech people?

“Both the seller and buyer are coming from the Triangle area,” Nick Phillips says.

Cycles: Landfall Micro Market

Realtors often speak of markets following cycles. Ace Cofer is one of them.

“It has taken almost 15 years for our market to return to pre-recession heights,” he says. “For example, Horseshoe Island in Landfall has had two vacant ICWW-front lots. In 2005, 1111 Pembroke Jones Dr. sold for $2 million and this year it sold for $1.925 million. That shows an example of what was happening in 2005, ’6 and ’7 and what is happening today. We are back to square one… and we have surpassed that (price) in certain micro markets.”

One Wrightsville Micro Market

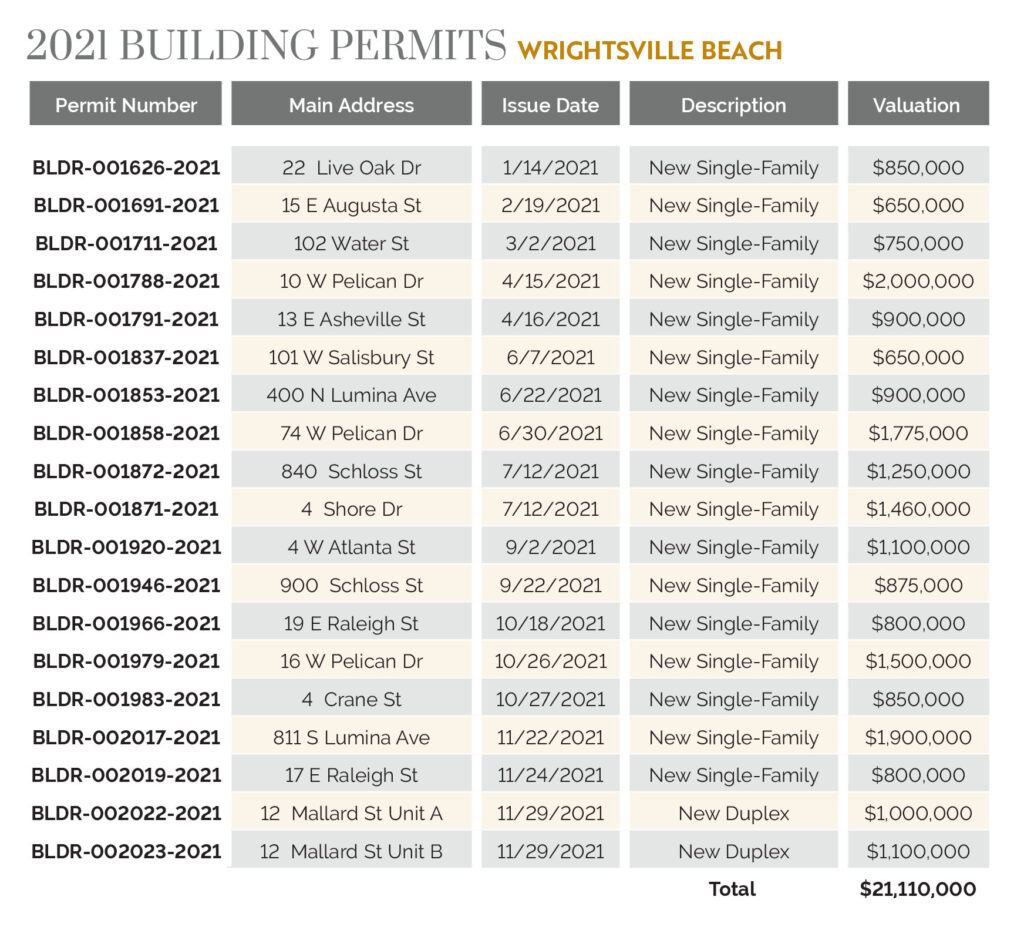

Approximately 40 of Wrightsville’s sales were single family homes, 110 were townhouses or condos. 2020 saw new condominiums at Atlantic View landward of Johnnie Mercers Pier sell out quickly. Days on market were few. New condo construction on Wrightsville Beach continued selling at record pace, including four at 123 S. Lumina Ave.

“We listed and [put under contract] four residential luxury condominiums and actually [did this] as soon as we had pilings in the ground. It is pretty unique for new construction to sell prior to a start,” says Evan Barton of Cadence Realty. [They were scheduled to close in early 2022.]

Ace Cofer offers an insightful micro market case study of 2021 on one oceanfront condo building, illustrating what it took to get back to the prerecession values.

“The highest price ever paid for a two-bedroom Station One condo was $850,000 in 2006. That was a prerecession high,” he says. “At the end of 2020 a two-bedroom Station one condo traded in the high 700,000s. As we entered 2021, a two-bedroom Station One condo unit 6-F traded for $805,000. The following sale of unit 3-J was $860,000, followed by unit 4-E for $910,000. We wrapped the year with a two-bedroom Station One condo closing for $930,000.”

Unit 6-G closed on Dec. 16, but he says it sat on the market at least 30 days at $975,000. There was not a bidding war, and it did not sell for full price.

“The consumers simply said no. Appreciation is taking place, yes, but that rapid appreciation scale did stabilize in that micro market at Station One. You couldn’t just keep asking $50,000 or $100,000 more than the last one sold for, the consumers drew a line in the sand,” Cofer says.

Investing in Land

Those who can afford to wait on product delivery, on other building projects to clear, and want a home of their own design are looking to purchase land, Jessica Edwards says.

She says 26 lots sold in Landfall in 2021 and as of Jan. 1 only five lots were listed for sale, with prices ranging from $250,000 to $1.9 million.

“We still see people wanting to buy land and build even with building prices being so high and things being delayed. It is an interesting part of the market,” says Edwards.

Others saw undeveloped lots as an investment to hold or to develop.

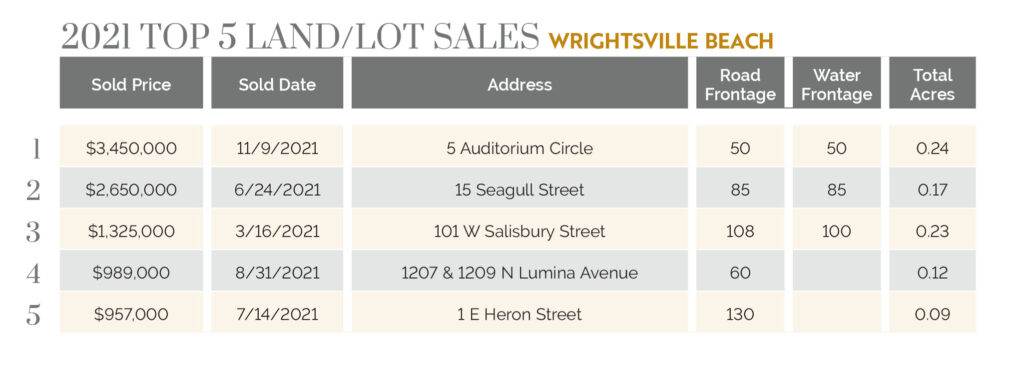

At built-out Wrightsville Beach, five lots were sold. Two of these were on Harbor Island, both facing east on Banks Channel. Both included boat slips and were near the fixed bridges to Wrightsville. The priciest, a 50-foot-wide lot located south of the south fixed bridge, 5 Auditorium Circle, took just 13 days to sell in November for $3.45 million. Deep water access counts.

Between the Banks Channel fixed bridges. 101 West Salisbury Street, with 100 feet of waterfront, closed in March for $1.35 million. It had been on the market at least 163 days.

The three additional lots sold included 15 Seagull Street, immediately north of Johnnie Mercers Pier, for $2.650 million dollars in June after being on the market seven days.

This was also the top residential lot sale in New Hanover County.

Pleasure Island, Carolina Beach and Kure Beach

By Jim McDonald

Pat Bradford and Christine R. Gonzalez contributed to this text.

The highest residential sale at Pleasure Island was 438 Oceana Way in Carolina Beach, which sold for $2.2 million cash, but the most unique might have been 406 Oceana Way, the No. 2 sale, with its unobstructed views on three sides of estuaries, marshes and ocean.

“It was a hard house to comp,” says Paul Buckman of RE/MAX Essential, who sold the home for $1.875 million. “The views were absolutely unique. The house had all the whistles and bells and 20 different remote controls to manage them all. But what made it really hard to calculate a comparable value of the property was the uniqueness of the view.”

The buyers had lived and worked in Canada and Europe and had looked at homes from Topsail Beach to Carolina Beach. The house was on the market for nine days and closed in less than 30.

Oceana Way saw a lot of action, with four of the top 20 Pleasure Island residential sales and two of the top 20 land/lot sales — 424 Oceana, which closed at $710,000, and 428 Oceana, with a sold price of $652,750.

A four-story, seven-bedroom (each with deck), canal-front home with deep water boat dockage and gazebo at 1107 Canal Drive sold for $1.845 million. It boasted 200-plus windows in 6,680 square feet. The 100’x160’ lot offered parking for eight vehicles.

Shanon Ives of Coldwell Banker Sea Coast Advantage sold a 5,000 square foot lot on North Carolina Avenue for $470,000 cash. It has an unobstructed view over the public beach access area.

“I think Carolina Beach and Kure Beach in general have been waiting to get to these values for a long time. Prices are where they should be and people are paying it because they are seeing the value,” says Ives.

Ten of the top 25 residential sales in Kure Beach were all oceanfront along Fort Fisher Boulevard, including 628 Fort Fisher Blvd. N. and 514 Fort Fisher Blvd. N., both selling for $2 million.

Hiram Tucker of Tucker Brothers Realtysays the welcoming climate attracted many buyers.

“I lived in North Dakota for two and a half years, and I know what it’s like to live in the cold climates,” he says. “If you have to go out in the morning and scrape ice from car windows that could make a difference on where you want to call home.”

Tucker says that year-over-year sales activity on Carolina and on Kure beachs was roughly the same.

“But it’s not that the market is flat,” he says. “It’s a lack of inventory. If we’d had more inventory, we could’ve sold it all.”

What is Drawing People

Buyers from all over the country and abroad were seeking and snapping up property in the three-county area.

“We are starting to see a lot of people come from California and other places they want to get out of,” says Tim Milam.

As a result, the market dynamic has shifted. It’s not a seasonal market anymore, but a year-round market and there’s been a geography shift.

“Covid has made Southeastern North Carolina so very attractive because of our climate,” Milam says. “Why live in New Jersey, New York or Virginia where there is cold and snow, let’s move to North Carolina where taxes are low. It’s been a dynamic change none of us expected.”

Regardless of where they were coming from, continuing themes were a desire for great outdoor entertaining space, dedicated work and play areas, and room for family gatherings.

“The biggest thing buyers want is seeing their family fit in the space — it needs to make sense for their family,” says Donna Waller of Landmark Sotheby’s International Realty. “I am seeing a little shift from open concept to people looking for more actual rooms. They are looking for functionality.”

Because COVID-19 was such a factor in 2021 and travel has become more challenging, people have poured themselves into their homes — as a haven for some but also a replacement for vacation traveling.

“Pools have been a big request, and more outdoor entertaining living space has been something of importance to clients. The views are always going to be a big feature, but we’ve seen more of the grounds and outdoor living space being an important factor in 2021,” Kirra Sutton says.

Intracoastal Realty’s Amy Formanek points to strong community activities as another reason for buyers choosing the area. Enhanced educational opportunities through UNC-Wilmington and Cape Fear Community College add to the area’s resources.

“Many of my buyers were looking in South Carolina and N.C. They decided on Wilmington for many reasons — lower taxes, the airport, historic downtown, cultural arts center, music venues, and a slower lifestyle than where they lived. It just so happens we have beautiful beaches, boat clubs, and a strong sense of community and clubs to interest residents,” Formanek says.

Another dynamic is with the housing inventory so low, people are filling up the plethora of apartments that have been built.

“People cannot find what they want, and want to move here, so that’s why all these apartments are filling up, there is a need for housing,” Tim Milam says.

Time is Money

Partly due to the extreme supply chain delays in receiving products, appliances and furniture, and the escalating cost of building and renovation materials, time became a factor in purchasing, renovating or building.

“If the price factor isn’t coming into play, the time factor is. I’ve heard crazy things about getting appliances for renovations being delayed month after month,” Jessica Edwards says. “And installing a pool can take a year.”

Houses ready for a buyer to step into and start living were in high demand.

“If someone is selling a property furnished and in good taste, that’s going to be very attractive to a buyer,” says Edwards. “The buyer wants up-to-date, current trends, big kitchens done and move-in ready. Those homes are selling at higher prices than something that needs renovation. People are willing to pay for a property that is ready to go. And that is at every end of the market. Those truly perfect move-in ready homes are selling at the top, top prices, including in Landfall.”

Realtor after Realtor agreed that current buyers are drawn to turnkey properties.

“The level of modernization of a particular residence, be that a house, condo, or townhome, is certainly one of the biggest components of its value,” says Ace Cofer. “The 2021 consumers really were willing to pay a premium over retail for a modern, turnkey interior. Late in the year, when we put two properties up in original condition, they just sat [on the market].”

However, perhaps because of the lack of inventory, teardowns and renovations are occurring all throughout New Hanover County. Hot spots include Porters Neck and the area near Cape Fear Country Club.

“A lot of areas have gone through transformative periods with teardowns, waterfront Bald Eagle Lane in Porters Neck is one of them, obviously Wrightsville Beach is another,” says Max Smith with Cadence Realty.

DOWNTOWN WILMINGTON

By Amanda Lisk

Unprecedented activity from one end of the spectrum to the other defined real estate sales in downtown Wilmington in 2021.

Two of the city’s most iconic historic properties were sold, both closing at or near $2 million.

The Dudley Mansion at 400 S. Front Street, built in 1825 and the residence of Edward B. Dudley, North Carolina’s first governor, sold for $2 million in April.

“It was an out-of-state buyer with ties to the state who wanted to get back,” says Ashley B. Garner of the Intracoastal team, who represented both the seller and buyer. “The seller was passionate about the house and did a lot of research and restoration, compiling the history into a book. It was fun to learn the history. It was a once-in-a-career type transaction.”

The 15,100 square foot, 12-bedroom Graystone Inn Bed and Breakfast at 100 S. 3rd Street, built between 1905 and 1906, sold in June for $1.925 million.

Both the Graystone Inn and the Dudley Mansion took some time to sell, typical for grand-scale historic properties.

“It takes the right buyer,” Garner says. “We are not competing with homes in Landfall. We are competing with other historic homes in places like Savannah, Georgia, and Charleston, South Carolina.”

Selling in less than a week or two and driving up sales in nearly every district of downtown were new and newly remodeled homes and condos/lofts in the $200,000 to $400,000 range.

New home communities such as Riverside at 432 Tributary Circle and Hanover Lakes at 287 Hanover Lakes Drive, located along the perimeter of downtown in the Wrightsboro area, offer new construction starting in the $300,000s. Many 2021 sales came from these two communities.

In the Brooklyn Arts district, the former Independent Ice House building at 614 Peacock Lane, built in the early 1900s, was rezoned, restored and repurposed into six multi-family lofts called Indie Ice House Lofts by Dave Nathans of Urban Building Corp.

“I’ve owned property in that vicinity for many years and that building has always intrigued me,” Nathans says.

All six lofts sold in less than a month, including two that were on the market for less than two days.

Todd Toconis of Town & Country Real Estate listed the properties.

“There’s a huge influx of people moving into the area from other states such as New York, New Jersey, Massachusetts, Pennsylvania, Ohio,” says Toconis.

Infill projects like the Indie Ice House Lofts in niche areas of downtown sold well. The lofts are next to the iron truss bridge — frequented in the backdrop of One Tree Hill episodes — that was used to carry ice via train and is now an integral part of the upcoming Wilmington Rail Trail project.

On South 8th Street, four two-story homes with clapboard siding were built on property that once housed a ranch-style home. The home was torn down, and the property was subdivided into four lots, which all sold in two days at prices ranging from $275,000 to $279,950.

“That was an excellent infill project,” Toconis says. “That is a National Register area. Most homes in that area are considered historic. The home that was on there before was incongruous with the area.”

Older homes updated and staged well sold quickly, only lasting one, two or three days on the market.

“We’ve never seen demand like this. If a home comes on the market in the morning, I will say, ‘We have to go see it and make an offer today or you’re not going to get it,’” says Ashley Garner.

A 901 square foot home at 804 S. 6th Street with current fixtures and finishes sold in two days for $190,000. A well-staged 1,400 square foot home at 210 Bermuda Drive sold in two days for $244,500, above asking price.

“It was right under an acre of land, you can’t find half-acre lots five minutes from downtown Wilmington anymore, that’s where the buyer found the value with such a large lot,” says listing agent Loren Baysden of Network Real Estate.

Developers and out-of-state investors pouring into downtown drove house prices up. In October, Parastream Development purchased seven acres of the Soda Pop District for $8 million that included the Coca-Cola bottling building on Princess Street. Plans are to transform the area into urban flex space with restaurants and storefronts.

“You are seeing increased investment in these niche districts, the Cargo District, North Fourth, Brooklyn Arts, the Rail Trail and the buzz around that and the Soda Pop District,” Baysden says. “The more developers invest, the more all house prices are driven up. Homes that used to sell for $50,000 to $60,000 that needed renovations are now selling in the low to mid $100,000s.”

Overall sales volume for the downtown Wilmington area in 2021 reached $25.7 million; just over $23 million in residential, with approximately $1 million in land and multi-family sales each. In 2020 the volume was $24.7 million.

Strategic Moves & Buyer Frustration

By Christine R. Gonzalez

While the rising list prices benefited sellers, knowing when and how much to list was a calculated chess move.

“It’s been a seller’s market like no other,” says Michelle Clark-Bradley, Intracoastal Realty.

“As a seller, once your home came on the market you needed to be instantly ready for back-to-back showings, navigating multiple offers, and securing your next place to live.”

There is a lot of strategic thinking behind pricing, listing a “coming soon” notice and when to have a property become active.

Conversely, Clark-Bradley draws an accurate picture of the frustrating ordeal home buyers faced in 2021.

“As a buyer, it was like running the Kentucky Derby every time a home came on the market in your price range — moving as vigorously as possible, battling with many strong competitors, and absolutely exhausting yourself. In the end, there’s only one winner, and you’re overjoyed when it’s you,” she says.

Buyers paid cash for 45 percent of the top 20 New Hanover County sales and half of the Pender and Brunswick top 10 sales.

“It was a frustrating year to be a buyer, as most often homes sold well above asking price, with high due diligence money, and for cash — which are difficult terms to compete with for many people,” Clark-Bradley says.

Second-Home Market

By Christine R. Gonzalez

Supply and demand are key figures in skyrocketing prices. In 2019 a very healthy U.S. economy and stock market climb began fueling a continued wave of second home purchases locally.

“There has been a huge demand for second homes in our region over the past three years and that is continuing. I believe COVID was a driving force in 2020 that continued in 2021,”says Nick Phillips. “From Topsail Island north down to Brunswick County beaches, our entire region is a magnet for second home buyers. From all across the eastern half of the country, but the Triangle specifically I see being a huge engine for us right now. The number of folks we have coming to buy second homes out of the tech sector in the Triangle is growing by leaps and bounds every year.”

Brunswick County

By Fritts Causby

Brunswick County witnessed significant price appreciation in 2021. The average sales price increased 75 percent, the median 11 percent. The sales volume exceeded $3 billion, with 9,786 units sold, a 16 percent increase. As with 2020, most listings received multiple offers and ended up closing well over the asking price.

“As soon as homes are listed, they are immediately pending and sales rarely fall through,” says Sarah Harris of Intracoastal Realty. “Sellers are in the driver’s seat, but they are few and far between. Very few owners are deciding to sell, even with the increase in values.”

Brunswick was no exception to the area-wide inventory drought, seeing a 37 percent decrease in the number of properties for sale through agents. The top sale of $6.15 million represented a 67 percent increase over 2020. Bald Head Island led with big ticket sales, with 11 of the top 12 in the county.

Harris represented the seller of the only top 12 home not on Bald Head. The No. 5 sale was a nearly 6,000 square foot oceanfront home at 1327 Ocean Blvd. W in Holden Beach. The popular vacation rental, with 12 bedrooms, a pool, and a projected income of more than $375,000, closed in May at $3.15 million cash after 156 days on the market.

The top sale in the county was 704 Shoals Watch Way, a sprawling waterfront home on Bald Head Island with 143 feet of ocean frontage on a nearly 1.4-acre lot designed by Peter Quinn and constructed by Dudley Builders in 2006. Along with the premium setting on a dune ridge at the end of a cul-de-sac, an elevator, and the approximately 5,207 square foot interior, one of the more unique features of the seven-bedroom property is the 40’x20’ stainless steel pool. It was sold by the original owners after 289 days on the market, closing in late July at $6.15 million cash.

“My clients were from Midlothian, Virginia, and had been looking for a dream vacation home from Norfolk to Miami,” says Stephen Prokop, Carolina Plantations Real Estate, who represented the buyer. “Having discussed all they wanted, I explained that while we will look at the four homes of interest, I needed to show them one more that was way above their original budget. We were in the home 15 minutes when they started asking questions about how to move forward with an offer.”

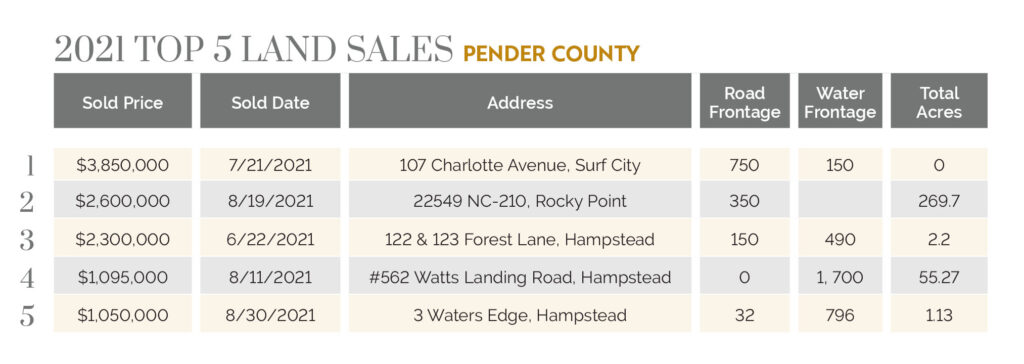

There were significant land sales in the county, including 18 between $1 million and $6 million. All but four of the top 25 land/lot sales were cash sales. Ten of the top 25 had waterfrontage.

In March, Supply saw a $6 million sale of 180 acres featuring 2,770 feet of waterfront. The property at 2188 Stone Chimney Road SW was a cash sale. Navassa had a 126.86-acre sale at 200 Cedar Hill Road, which sold for $5.6 million in August. In November, Shallotte saw a $2.562 million cash sale of 112.33 acres with 3,000 feet of waterfront at 4571 Smith Avenue. A 67-acre tract off Star Cross Way SW with 2,500 feet of water frontage sold for $870,000 cash in July, the No. 22 land sale in the county. Leland’s top land/lot sale, No. 18 in the county, was 4.58 acres at 1791 Leland School Road NE. It was a cash sale for $1.05 million in late November.

PENDER COUNTY

By Amanda Lisk

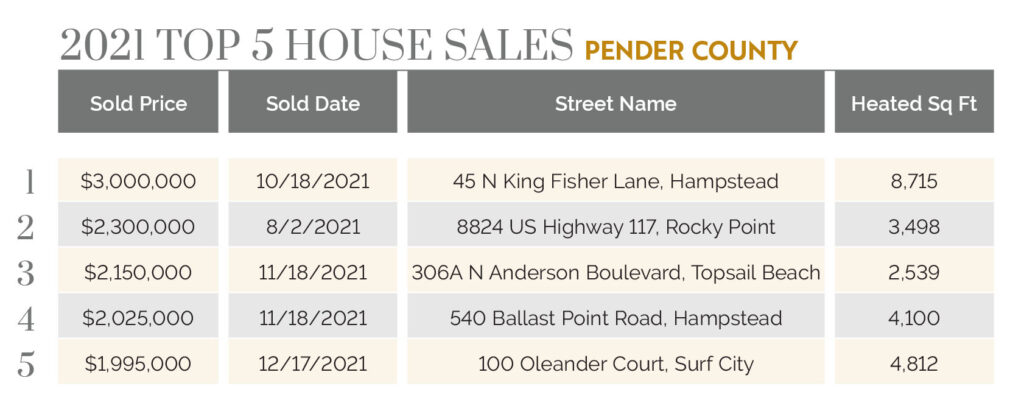

Pender County’s top land and residential sales of 2021 raised the bar by significant margins over 2020.

A tract of land at 107 Charlotte Avenue in Surf City that stretches from the ocean to the sound and is subdivided into 14 lots closed at $3.85 million on July 21, $1.8 million higher than the top land sale the previous year.

The highest residential sale was an 18-acre waterfront property at 45 N. King Fisher Lane in Hampstead. It closed at $3 million on Oct. 18, beating out 2020’s top sale of $2.3 million. The main house of more than 6,000 square feet, separate pool house, five-stall barn, boat dock and 18 acres of pastures drew high interest.

“It’s a very unique property, there’s not another one like it. Typically, if you want a barn and acreage, you have to give up also wanting waterfront, but with this estate, it had it all,” says Dawn Berard, listing agent and owner of Sold Buy the Sea Realty.

In Rocky Point, there were three sales in the $2 million range.

The Old Homestead Farm at 8824 U. S. Highway 117, home to the annual Christmas in the Country light show and weddings and events, sold in August for $2.3 million. The picturesque 100-acre property adorned with live oak trees has a main farmhouse, venue barn, nine-stall horse stable, riding arena and horseback riding trails.

Also in August, the 269-acre Long Creek Farms sold for $2.6 million, and in October a newly renovated lakefront estate on 1055 Cheshire Road sold for $1.85 million.

“We had a showing the day it hit the market and had a contract the very next day,” says Caroline Watkins with BlueCoast Realty, the listing agent of both Long Creek Farms and Cheshire Road.

In all, Pender County reached nearly $870 million in sales volume with more than 400 sales pending at the end of the year.

Topsail Island accounted for nearly $64 million of Pender County’s total sales.

A Surf City beachfront home at 1018 S. Shore Drive, featured on HGTV’s Beach Hunters, sold in September for $1.985 million after seven days on the market. The sellers had purchased the home new in 2019 for $1.472 million.

Kristin Kelly Freeman of BlueStar Real Estate represented the sellers when they purchased the home. She was also their listing agent.

“When they bought the home two years ago, it was right after the old swing bridge was replaced with the gorgeous new 65-foot-high, $53 million bridge with a 10-foot-wide multiuse path and bike lane,” she says. “I was pleased to see how much my sellers’ investment increased in value in this short time frame.”

Figure Eight Island

With a closing price of $5.712 million, the top 2021 Figure Eight Island sale — No. 4 in the county — set a Realtor record for the island. The price was $200,000 over 2020’s top home sale. The buyers of the 4-bedroom, 5-bath home at 8 Beach Road South were local to North Carolina with family in Wilmington.

“One thing that motivates some of my existing customers is to have a special place to pass on to their children, grandchildren and extended family,” Figure Eight Island Realty’s Kirra Sutton says. “Several even purchased an additional second home to be able to have family near a property they owned.”

The island saw its sold volume cut by half due to a scarcity of houses for sale. Just 13 properties were sold in 2021, and there was literally no inventory to purchase on Jan. 1, 2022. (“There were a couple $6 million private sales in 2021,” Intracoastal’s Buzzy Northen says.) The average sale price was up 23 percent, and the median up 30 percent.

“It’s totally historic, the lack of inventory. It is unprecedented,” says Buzzy Northen.

Notable Equestrian Estate Sells

525 Longhorn Creek Lane • Sampson County

A sale of significant distinction was made in Sampson County in late December 2021 by Wilmington Realtors Landmark Sotheby’s. The 1,200-acre Longhorn Creek Ranch, said to encompass a space larger than Central Park in New York City, sold for $7.19 million, a record for the North Carolina regional MLS (southern half of the state). The Santa Fe, New Mexico-inspired equine breeding and training facility and cattle breeding operation includes a Stan Gralla/GH2 Architects-designed main barn complete with veterinary lab facilities and a 3,000 square foot residence above, which offers a viewing area overlooking a 100’x 200’ indoor arena. A stocked 20-acre lake, guest cottages, pastures and paddocks, outdoor arenas, hay barn, silo and maintenance buildings also dot the site.

Supply and Demand

Realtors began the year with cautious optimism and likely could not have even dreamed up the stiff increase in pricing.

“The housing shortage was predicted years ago with the longevity of baby boomers, plus millennials getting married, having kids and buying houses,” Jessica Edwards states. “And nobody predicted COVID would come along. I think there is still going to be a shortage of supply compared to demand in 2022.”

No one has a crystal ball that can predict what the housing market will be like throughout 2022, but optimism for steady, continued growth is strong.

“I was shocked with what happened this year. I didn’t think it was possible,” Trey Wallace says.

Anticipated business growth will add to the housing squeeze.

“I do not see the Cape Fear region, or Raleigh, North Carolina becoming less desirable anytime soon. I believe people will keep coming. And they are going to want to buy some property when they get here,” says Randall J. Williams.