2011 Real Estate Roundup – Sea Change

BY Pat Bradford

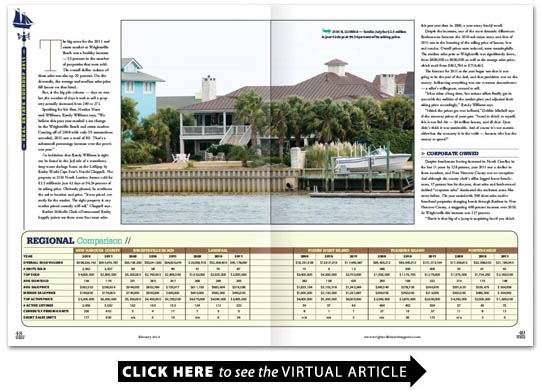

Sea Change The big news for the 2011 real estate market at Wrightsville Beach was a healthy increase 53 percent in the number of properties that were sold. The overall dollar volume of these sales was also up 29 percent. On the downside the average and median sales price fell (more on that later). But in the big plus column days on market the number of days it took to sell a property actually decreased from 289 to 272. Speaking for his firm Hardee Hunt and Williams Randy Williams says “We believe this past year marked a sea change in the Wrightsville Beach real estate market. Coming off of 2010 with only 59 transactions recorded 2011 saw a total of 89. Thats a substantial percentage increase over the previous year.” An indication that Randy Williams is right can be found in the July sale of a waterfront deep water dockage home on the Lollipop by Realty World Cape Fears Harold Chappell. The property at 2101 North Lumina Avenue sold for $2.5 million in just 42 days at 94.34 percent of its asking price. Obviously pleased he attributes the sale to location and price. “It was priced correctly for the market. The right property in any market priced correctly will sell ” Chappell says. Realtor Michelle Clark of Intracoastal Realty happily points out there were four more sales this past year than in 2006 a year many fondly recall. Despite the increases one of the most dramatic differences Realtors note between the 2010 real estate scene and that of 2011 was in the lowering of the selling price of houses lots and condos. Overall prices were reduced some meaningfully. The median sales price at Wrightsville was significantly down from $800 000 to $600 000 as well as the average sales price which sunk from $862 784 to $718 463. The forecast for 2011 as the year began was that it was going to be the year of the deal and that prediction was on the money. Influencing everything was one common denominator a sellers willingness or need to sell. “It has taken a long time but serious sellers finally got in sync with the realities of the market place and adjusted their asking price accordingly ” Randy Williams says. “I think the prices got over inflated ” Debbie Mitchell says of the runaway prices of years past. “I used to think to myself this is not Bel Air $4 million houses and all that. I just didnt think it was sustainable. And of course its not sustainable when the economy is in the toilet because who has the money to spend?” Corporate owned Despite foreclosures having increased in North Carolina in the last 11 years by 138 percent year 2011 saw a decline in those numbers and New Hanover County was no exception. And although the county clerks office logged fewer foreclosures 17 percent less for the year short sales and bank-owned dubbed “corporate sales” dominated the real estate scene like never before. The year ended with 900 short sales and/or foreclosed properties changing hands through Realtors in New Hanover County a staggering 408 percent increase over 2010. At Wrightsville this increase was 217 percent. “That it is that big of a jump is surprising but if you think about it people really feel like they can get the best deal if they get a foreclosure or a short sale and in a lot of cases you can but not all the time ” Michelle Clark says. “But some people are only going after foreclosures and short sales because they want to get such a great deal and theyre getting them. There are tremendous opportunities and most of them are short sale and foreclosure. Investors are buying trying to get the best deal and its also people that will be using it but they still want to get the best deal for that price thats all people care about right now … value value value deal deal deal cheap cheap cheap.” Randy Williams comments “Many of the issues with troubled properties have been resolved either through bankruptcy foreclosure or the short sale process. Wrightsville Beach was not immune from those calamities but it was not of epidemic proportion like it was in so many other communities.” New Hanover County by the numbers The county was up almost 10 percent in the number of properties or “units” sold with an additional 452 waiting to close after the year ended. However the county was down in overall sold volume but this was less than one percent; closing the year with volume totaling $693 476 787. The county was down in average sale price and also down in median sale price; across the board prices fell in every community. And there are still plenty of inventories; the number of active listings at years end in the county increased 2.57 percent. It took longer to achieve a sale county wide; the days a property sat on the market was also up from 136 to 174 days. Landfall Landfall the amenity-rich gated community was down in overall sales volume and in number of units sold. Sales volume saw a decrease of 14 percent to $45 178 090. Unit number declines were even greater at 16 percent. This Wrightsville Sound community has 1 500 homes already built out of a possible 1 953 total units. In 2010 total properties sold were 104; of these 79 were homes and 25 lots. For 2011 87 total properties sold of these 59 were homes and 28 were lots. Alison Bernhart Broker/Owner of Landfall Realty attributes this to political uncertainty. “The real downturn last year began mid-summer with the Congressional debates and picked up by year end ” she says. The top sales price of $2 500 000 was up but overall Landfall was also down in median and average sales price and up in days on market: 246 to 265. Likewise short and corporate sales rose from six to 24. Figure Eight On Figure Eight Island private luxury island living was up in overall sales volume 35 percent to $17 449 687. The number of units sold jumped 117 percent but keeping it in perspective that was just from six to 13. The island saw a significant drop in the top sales price sinking from a 2010 high of $4 million to a more conservative $2 750 000. Fairly telling the hike in days on market was way up a whopping 269 percent to 425. And Figure Eight logged at least two corporate-owned or short sales by Realtors. There too the median and average sales prices reflected what happened: The median sunk from $2 150 000 to $1 237 687 and the average likewise declined 37 percent to $1 342 284 but when contrasted with all other markets in the county those median and average sales prices remind observers that Figure Eight is still a strong value. Pleasure Island Kure and Carolina beaches The beach towns on the southern end of the county saw a similar fate but overall sales volume was up slightly less than eight percent. The number of units sold was also up just under 22 percent. And the top price in the two towns was also up edging up from $1 175 750 to $1 275 000. Still logging the increases the days on market on this island climbed from 186 to 222. The median sales price was down from $250 000 to $216 000 and the average sales price dropped from $278 706 to $246 976. The big news at Pleasure Island as in the larger county was the sharp increase in the number of foreclosures or short sales that Realtors handled a hike of 378 percent. Overall active listings increased from 402 to 504. Wrightsville digging deeper Besides the great news in number of units sold Realtors are pleased with Wrightsvilles $14.6 million increase in sales volume. “Several factors contributed to this. We feel there is some pent up demand from buyers trying to gauge the bottom of this market Guessing the bottom of any market is always tricky. Nobodys going to ring a bell when we hit it ” Randy Williams says. “Some buyers are starting to sense that.” Wrightsville was also up in the top sales price of any home; Randy Williams firm sold South Harbor Islands 26 Island Drive garnering the top price in the county as well as Wrightsville Beach of $2 895 000. The top two sales for the previous year were $3 495 000 and $4 000 000 respectively. Single-Family Homes Twenty single-family home sales (SFH) were logged at Wrightsville Beach for the year. All were water view or waterfront. The oldest home to sell was 314 South Lumina Avenue. Built in 1911 this waterfront cedar shingled cottage was sold as a “MLS only” listing one in which the seller acts as his own agent; buyers and buyers agents contact and contract with the seller directly. It sold for $1 250 000. Twelve single-family homes sold on Harbor Island for a combined total of 32 single-family homes. Ten of these were water view or waterfront (two). Michelle Clark says of this phenomenon “That is not necessarily surprising because people always want waterfront and water view and now is the time to buy; prices were so high before people couldnt afford it and prices have come down so now is the time to get the waterfront and water view you couldnt get before.” Eight of these single-family homes were corporately owned and that number was evenly divided between the two locations. A striking example of the impact corporately owned homes are playing can be found in the December sales of technically new construction twin houses at 306 and 304 Coral Drive. The homes are mirror images of each other constructed on a subdivided lot developer built in 2005/06. Both went back to the bank and were sold for $620 000 and $621 500 respectively. The calculated heated price per square foot (sf) was $177 and $178. Broker for those sales Pat Canady Century 21 Sweyer and Associates said in mid-January 2012 of the larger Wilmington marketplace “I think we have hit bottom. Banks are less likely to take a deal.” And that opinion plays out in the selling price percentage over list price which for Harbor Island for just the four corporate sales was 92.7 percent. Non-corporately owned SFH properties saw more play between list and sold price with that average sinking to 88.44 percent without the corporate sales. Combined the average was 89.86 percent list to sales price for Harbor Island single-family homes. The most expensive house to sell countywide 26 Island Drive brought 89.08 percent of its list price to sell at $612 per sf. The most economical buy at Harbor Island was the two-story house at Over on the island the most economical buy in a Wrightsville single-family home by price was the two-story frame house at 29 West Greensboro Street built in 1949 that sold for $330 000 which was $198 per sf with a water view but the house was scrapped. New construction on the lot was in the framing stage in January 2012. The most economical by price per sf was 11 Palmetto Drive with water views on Parmele Isle. This 1998 two-story construction sold for just $194 per sf. Both of these sales were corporate sales. Top dollar as seen as price per sf was also on Parmele: the 1965 waterfront year-round home at No. 5 Bermuda Drive. The home sold for $1 350 000 which was $1 071 per heated and cooled sf. The location features a large lot with a private pier and a 30-foot floating dock (ground floor living space was not included in calculations). Schloss Street again saw high activity with four sales in 2011; selling were Nos. 725 821 824 and 830. On the lower end No. 830 brought $670 000; No. 725 even less at $600 000 or 313 per sf; No. 824 the newest built in 1995 sold for $775 000. And built in 1978 No. 821 selling in March for 72.61 of its list price brought the top price on the street at $835 000 which was $340 per sf. In duplex sales Wrightsville saw nine traditional duplex and two triplex sales: triplex Unit 3 a corporate sale at No. 9 Birmingham Street sold for $339 000 or $254 per sf. And at 107 North Lumina Seawinds #C sold for $207 500 or 419 per sf. Of the nine duplex sales all were oceanfront or oceanview and none of these were corporate sales. The best buy in a Wrightsville duplex was 16B Greensboro Street which sold for $600 000. Built in 1997 this 4-bedroom 4-bath unit sold in November for $257 per sf. But the best buy at $421 per sf may have really been No. 2 Chadbourn Street the 4263 sf oceanfront luxury duplex that sold for $1 750 000 (ironically the price originally paid when the unit was new construction in 2001). Harbor Island saw two non-traditional duplex sales both on Coral Drive: Nos. 17 and 301. They sold for $384 500 and $395 000 respectively. Both are marsh front with sunset views built in the early 1970s. The former was a corporate sale and the latter was a short sale. Harbor Island saw one sale in a quadraplex building 211 Seacrest Drive Unit C. This 1983 soundview quad sold for $362 500 or 319 per sf. Two fractional sales were closed by Realtors both on Shearwater Street at $99 900 and $100 000 respectively. Pulling down the overall averages in any market these fractional vacation ownership sales of weeks (only) of ownership sink the average sales price across the board. Lot sales There were four lot sales in Wrightsville Beach a community without much vacant land; two of these were on Harbor Island and two on Wrightsville. The high sale was $750 000 for the oceanview lot at 836 South Lumina Avenue and the low was $317 000 for a lot with a water view at 22 Live Oak Drive. Just 12 days into the year 103 Live Oak Drive also sold at a price of $350 000 and 15 West Henderson brought a price of $400 000. Looking Forward The new tax valuations may or may not play a part of the market this year but tax appraisal values dropped at Wrightsville from $3 billion to $2.2 billion (before all the appeals have been filed or dealt with). County tax administrator Roger Kelley supplied numbers which indicate a 27 percent decrease in the residential (only) values attributed to Wrightsville properties for taxing purposes with the upcoming reevaluation while the county logged in at a 21 percent decrease. Kelley said there were 1 193 residential properties over a million in dollars in value for 2011 at Wrightsville Beach but that in 2012 there are just 653 valued for tax purposes at over a million dollars. All Realtors we spoke to agree the runaway prices of the years past are history. “Ancient history ” Randy Williams calls it. Bobby Brandon agrees “I dont think itll come back like that like those crazy prices we saw.” However many Realtors feel optimistic about the year ahead. Bobby Brandon predicts “Buyers are starting to see the higher end properties start to move and cash a lot of cash buyers. There are buyers out there moving in all the price ranges now and were obviously seeing more of them which is a good good sign.” “A third factor is the lending environment ” Randy Williams says. “Although a much more arduous process than it used to be the banks are loaning money again and rates are still historically low.” “I do believe that this year will be better than last year ” Debbie Mitchell says. “When Wrightsville Beach turns itll turn all of a sudden everyone starts picking stuff up and then theres no inventory left and that pushes the prices up and then you miss the boat.” “Wrightsville Beach has not lost any of its appeal. In fact it has gotten even better. Individuals and businesses are currently sitting on unprecedented piles of cash. For a lot of people real estate is shaping up to be a pretty good bet for 2012. We are counting on it ” Randy Williams says. *All listings and sales figures are as of 1/6/2012.

noun

1. a striking change as in appearance often for the better

2. any major transformation or alteration

3. a transformation brought about by the sea

15 Jasmine Place built in 1959. It sold for $376 951 or $166 per sf. This was a corporate sale.